The USD is mixed with declines vs the commodity complex (CAD, AUD and NZD)

As the North American session gets underway, the CAD is the strongest and the EUR is the weakest. The USD is mixed as the markets await retail sales (expected to rebound from Febs weather declines), Initial and continuing claims (have been surprisingly disappointing over the last two week), Philly Fed index, existing home sales, Industrial production and Business inventories. There will be more Fed Speak as well today. The AUD and NZD are continuing there moves to the upside today after transitioning from non-trend to trend yesterday.

Looking at the ranges and changes, the overall price action is modest with all the major currency pairs trading a pretty good distance away from the 22 day averages (red line in the lower chart below). The EURUSD, and USDJPY ranges are only 31 pips. The USDCHF is even lower at 26 pips.

In other markets:

- Spot gold is trading up $14.40 or 0.83% at $1750.85

- Spot silver is trading up $0.22 or 0.87% at $25.64

- WTI crude oil futures are trading down $0.35 or -0.55% at $62.80

- Bitcoin is trading up $213 or 0.34% at $62,585

In the premarket for US stocks:

- Dow +176 points

- NASDAQ +119 points

- S&P +24.59 points

In the European markets:

- German Dax +0.2%

- Frances CAC, +0.30%

- UK's FTSE 100 +0.3%

- Spain's Ibex unchanged

- Italy's FTSE MIB, Unchanged

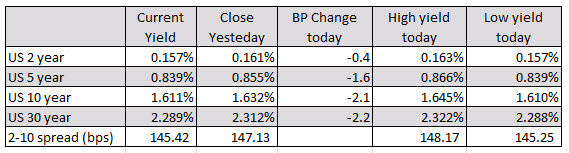

In the US debt market yields are moving lower with the 2-10 year spread also contracting to 145.42 to 147.13 basis points. The 10 year yield is down -2.1 basis points:

In the European debt market, the benchmark 10 year yields are trading lower across the board as well: