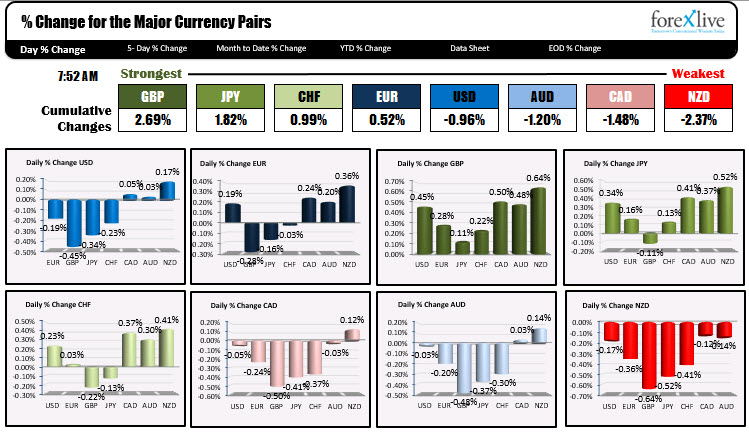

The USD is mixed

Yesterday was a risk-on day as traders locked onto the Moderna vaccine news. Today is a different story as the impact from the sharp rise in covid cases and hospitalizations reverse the trend. The commodity currencies are the weakest. The morning snapshot is showing the GBP is the strongest along with the JPY, while the NZD, CAD, and AUD are all moving lower and fighting it out for the weakest of the major currencies. Retail sales will be reported in the US for October is the major release today.

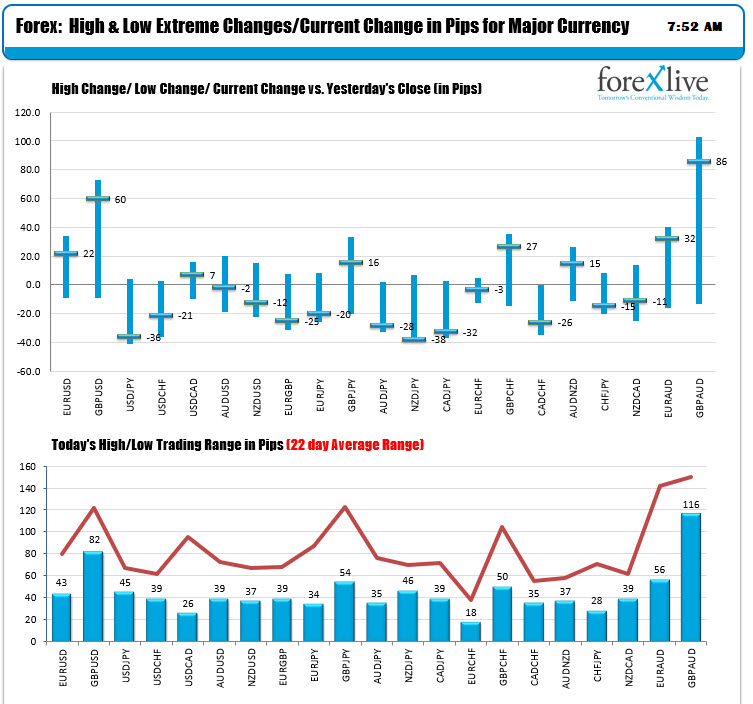

The ranges and changes are showing modest low to high trading ranges compared to the 22 day average (about a month of trading) with the exception being the GBPUSD. For the GBPUSD, after an earlier dip to the downside found support at the 100 hour MA, the price has bounced higher. Most of the JPY pairs are lower with the exception of the GBPJPY which is following the strength of the GBP.

In other markets:

- Spot gold is trading down a modest -$2.10 or -0.11% at $1886.80.

- Spot silver is trading down $0.13 or -0.53% 24.dollars and $0.63.

- WTI crude oil futures are trading down $0.30 or -0.7% at $41.05

In the premarket for US stocks, the futures are implying a mixed opening. Tesla will be added to the S&P index and is up sharply. Amazon announced that they would be entering the over-the-counter prescription market. Home Depot reported better-than-expected earnings and revenues but also announced that expenses would go up by $1 billion over the next year as they reward employees with higher pay for getting the company through Covid (good for them):

- Dow industrial average, -221 points

- NASDAQ index +28 points

- S&P index -20 points

In the European equity markets the major indices are mostly lower with the exception of the Italian FTSE MIB. The major indices showed solid gains yesterday to start the week:

- German DAX, -0.4%

- France's CAC, -0.3%

- UK's FTSE 100, -1.2%

- Spain's Ibex, -1.3%

- Italy's FTSE MIB, +0.2%

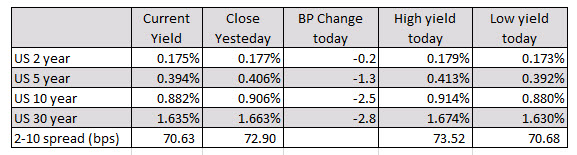

In the US debt market, the yields are lower with the yield curve flattening by a few basis points:

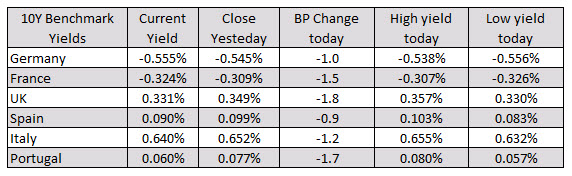

In the European debt market, yields are also lower across the board in the benchmark 10 year yields.