Yield curve flattens more in the US

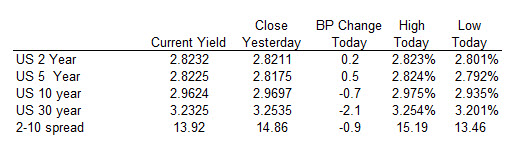

The JPY is the strongest. The USD is the weakest as NA traders enter for the day. Lower stocks - after a Monday rally after the US/China trade truce - has been a catalyst. Yields are also moving lower and the yield curve flattening. The 2-10 year yield curve in the US has flattened to the narrowest level in over a decade. The 2-5 year is now negative as well. When the yield curve goes negative it is in response to the potential for a recession. For the GBP, it is an up day today ; ), after yesterday's down day. The ups and downs continue.

The ranges and changes show the USDJPY trading at the days lows (down -88 pips). The range of 93 pips is already above the 22 day average range. That pair is trending lower. The GBPUSD is also on the move (to the upside) although off the highs. The AUDUSD and the NZDUSD is higher after the PBOC strengthened the fix by the most since June 2017. That seemed to help those currencies despite the fall in stocks.

In other markets:

- Spot gold is up $8.37 after strong gains yesterday. The dollars fall is helping to push the precious higher. The price is up 0.70% at $1239.31

- WTI crude oil is up $0.92 or 1.72% at $53.85. The OPEC meeting is at the end of the week and traders are jockeying for position ahead of what may be some production cuts. The high reached $54.55. The low reached $53.03.

- Bitcoin on Coinbase is up $91 at $3966. The price high reached $3993. That high was just below the 200 hour MA at $4001 and the 100 hour MA at $4013. Stay below is more bearish. Move above is more bullish. Right now, the price correction is keeping a lid against those MAs (keeping sellers in control).

The US stock futures are implying a lower opening:

- Dow, -111 points

- S&P, down -10 points

- Nasdaq -45 points

European shares are lower

- German DAX, -0.6%

- France's CAC, -0.47%

- UK's FTSE, -0.73%

- Spain's Ibex, -0.93%

- Italy's FTSE MIB -0.68%

Yields in the US are lower and the yield curve continues to flatten. As mentioned the 2-5 year spread has moved into negative territory today. The 2-10 spread has a 13 handle.