October 19, 2015 North American open

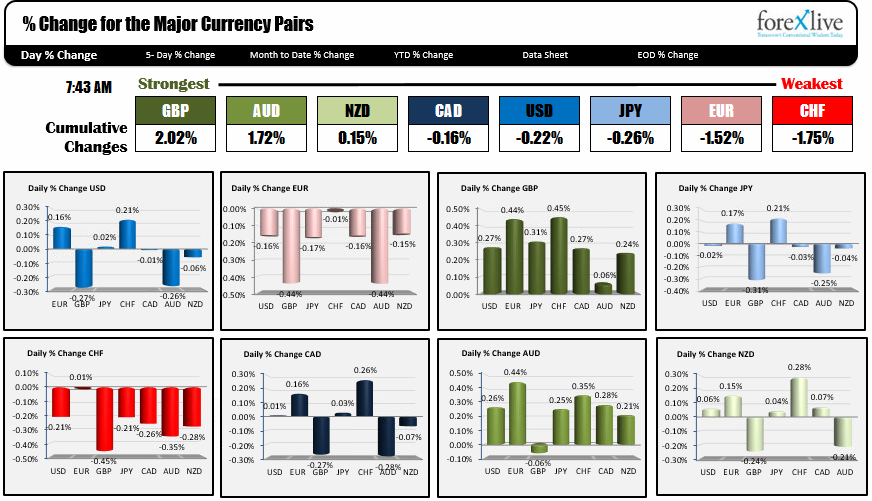

Below is a snap shot of the strongest and weakest currencies as North American traders enter for the trading day.

The GBP is the strongest, while the CHF is the weakest. The rank is determined by calculating the change from the prior day close of the major currencies vs. each other and adding those changes. The highest sum, is crowned the strongest. The lowest is the weakest. NOTE: the values are not weighted.

In the table above, the GBP is the strongest. It is higher vs. all the other major currencies. The pair remains buoyant against the EUR (higher by 0.44%). Today the EURGBP price fell below a floor at the 0.7335 area (see EURGBP chart below).

It is also strongest against the CHF today (+0.45%). Against the greenback the pair continues to have problems above the 100 day MA (today at the 1.5488 level - see chart below).

Last week the pair traded above the 100 day MA on Wednesday (one hourly bar close above) and Thursday (traded 11 hourly bars above, but with only 4 closes above), but momentum could not be sustained (see GBPUSD chart above). On Friday traders leaned against the key MA to define risk. Activity was light on Friday with a narrow trading range. Today, the price moved back above the key MA level, but is currently trading back below the key level (100 day MA is at 1.5488)

There is little on the economic calendar. At 10 AM the NAHB index will be released with the est at 62, unchanged from the the prior month. Fed's Brainard speaks on regulation. Focus will likely be on the Q&A. On October 12th Brainard was more dovish in her comments as she refused to put any timetable on rate liftoff. Feds Lacker speaks at noon (ET). The topic is childhood education. I am not sure there may be any policy comments before, during or after, given that topic.