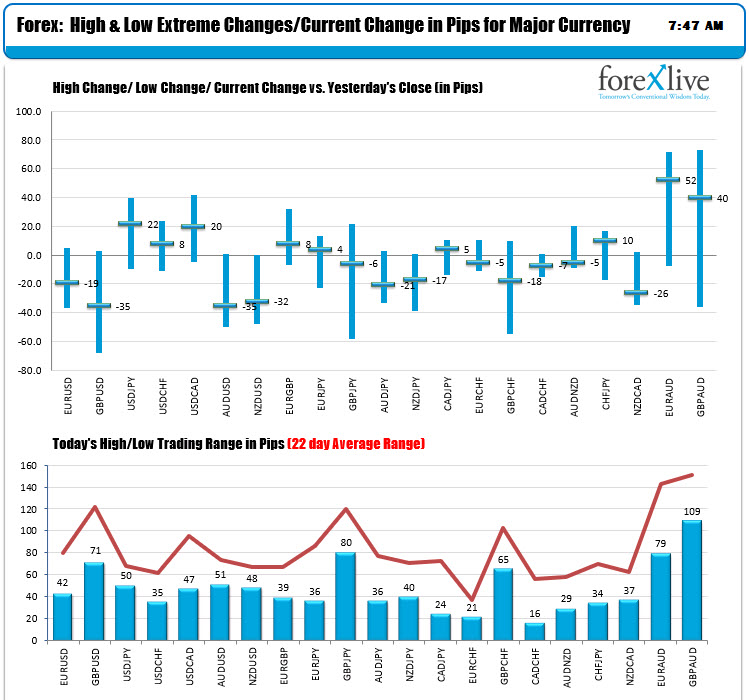

The ranges are relatively modest

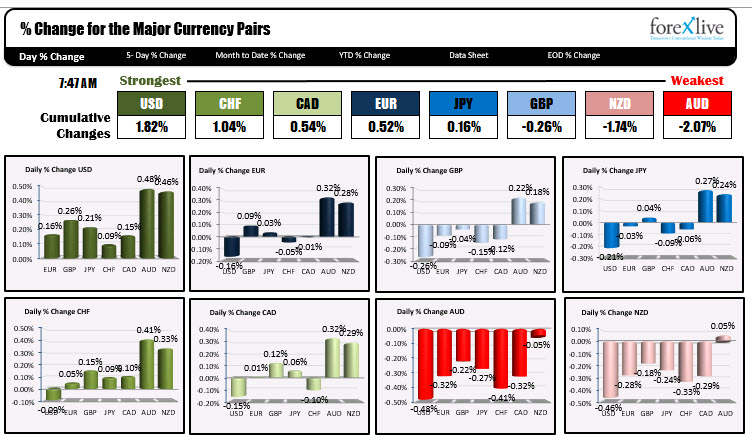

As the North American session begins, the USD is the strongest of the majors, while the AUD is the weakest. The ranges are relatively modest. The levels are off extremes as well as the day begins. The tug of war between good vaccine news and expectations of the worst is yet to come is weighing on the market sentiment. Even the NZD which reached a near 2 year high yesterday, started to push back lower today despite relative low case count in that country. They did make masks mandatory from Thursday for users of public transport in Auckland as well as on all domestic flights. Japan cases reached a new record yesterday. The hospitalizations are up to 79K.

The ranges and changes reflect the price action off extremes. However, the USD has been mostly higher (with small declines vs the majors in trading today). The EURGBP is back near unchanged after rising earlier. The JPY crosses are mixed.

In other markets:

- Spot gold is trading down $10.60 or -0.57% at $1861.44

- Spot silver is trading down $0.43 were -1.81% at $23.89

- WTI crude oil futures are trading down $0.20 or -0.48% of $41.62

In the premarket for US stocks, the futures are implying modest declines

- Dow -44.42 points

- NASDAQ -13 points

- S&P index -5 points

in the European equity markets, the major indices are lower as well

- German DAX, -0.55%

- France's CAC, -0.55%

- UK's FTSE 100, 10.6%

- Spain's Ibex, my 0.5%

- Italy's FTSE MIB, -0.2%

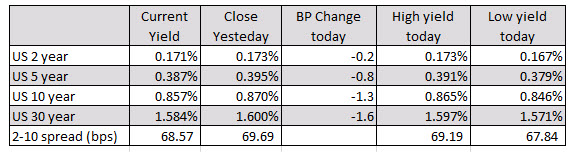

in the US debt market, yields are lower with the yield curve narrowing prime less then a basis point:

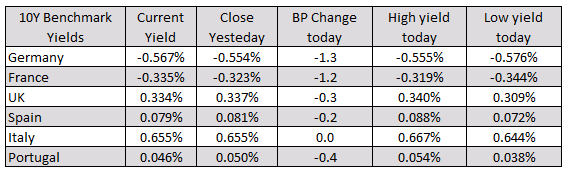

In the European debt market, the benchmark 10 year yields are lower as well.