The road to the target has not been a smooth one

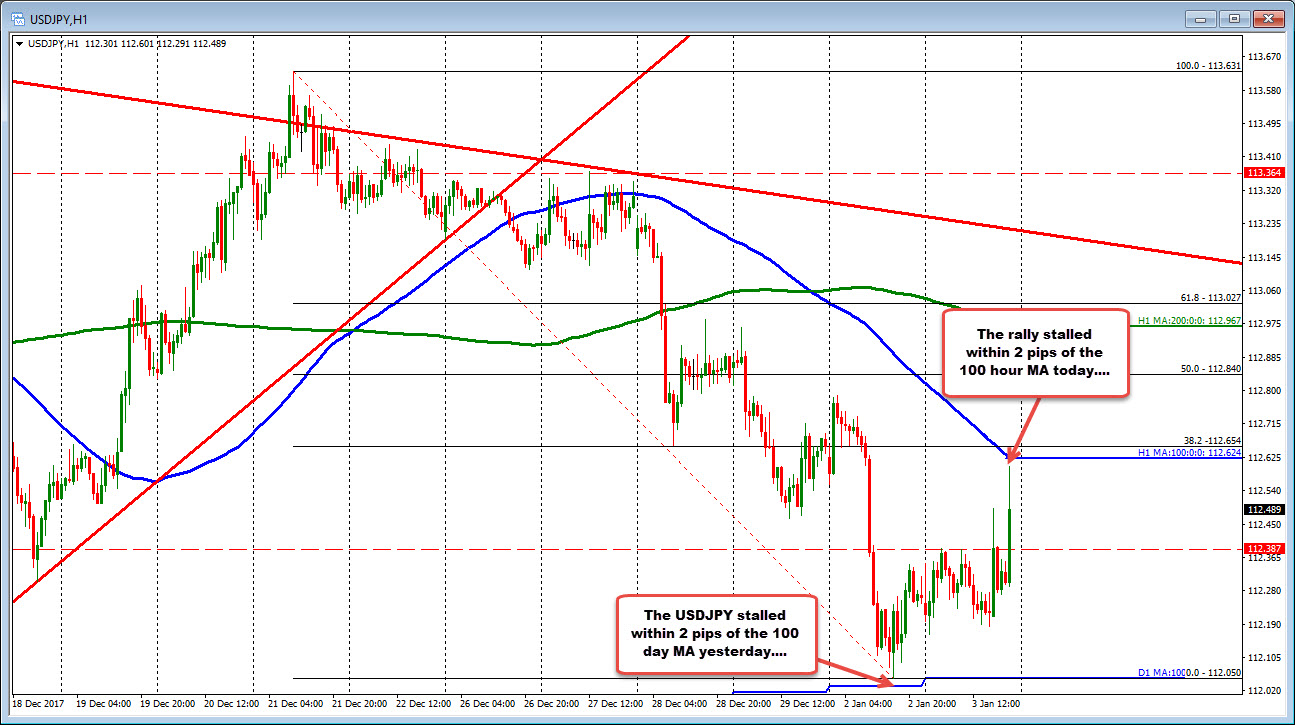

Earlier the USDJPY broke to new session highs and extended a narrow trading range. A key target would have been the 100 hour MA (blue line in the chart below). However, the extended gains above the earlier high was retraced, with the price moving back into the old range for the day.

The FOMC minutes, however were more hawkish and the road back higher was restarted. The price moved up to a high of 112.60. That was just short of the 100 hour MA target which currently comes in at 112.624.

So the road to the target was nearly complete for the day but the path was not so smooth.

What now?

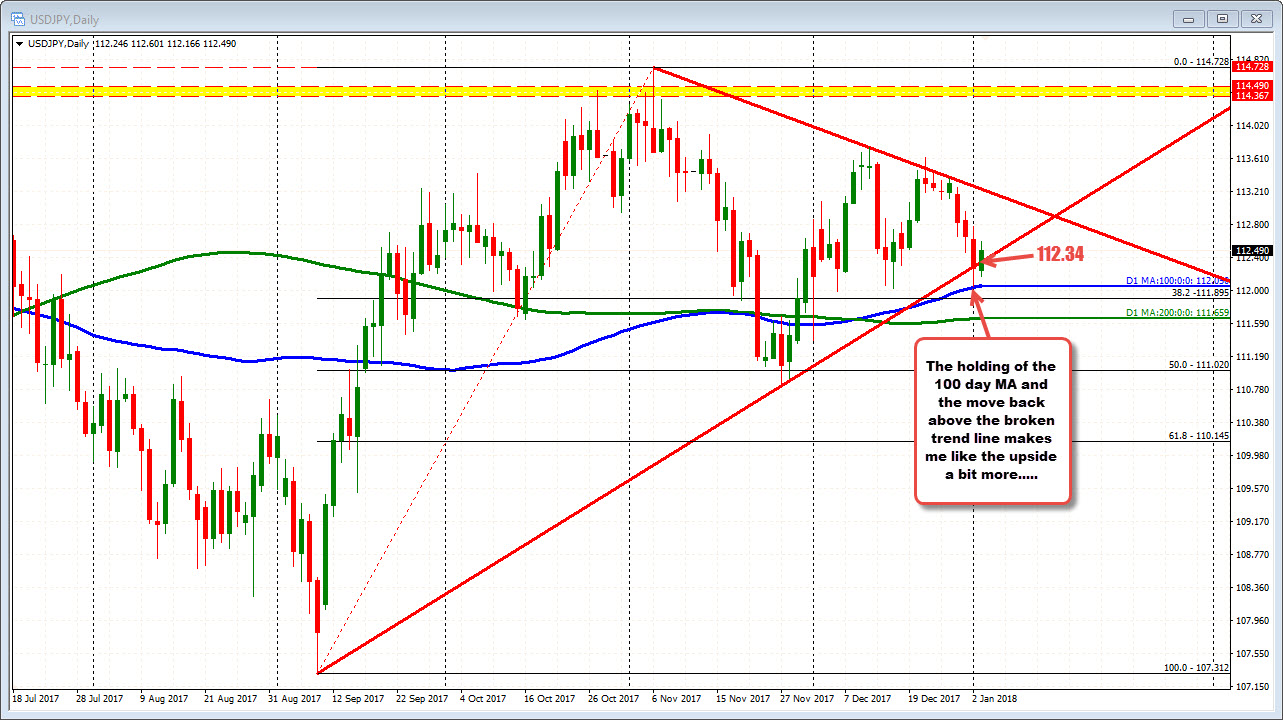

Since bottoming near the 100 day MA (got within 2 pips of that MA yesterday), the price action is corrective to the upside, but certainly not a runaway train. That should keep traders either cautiously bullish, or cautiously bearish - depending on your perspective. You could be both technically.

For me, I give the nod a little more to the upside on the back of the hold against the 100 day MA and the move back above a trend line on the daily chart at 112.34. Stay above the both is more bullish, but we do need to extend and get above the 100 hour MA. Failure to do so, will disappoint the longs. Watching 112.34 now. Stay above is more bullish.