The initial reaction in the US dollar is strength following another excellent jobs report.

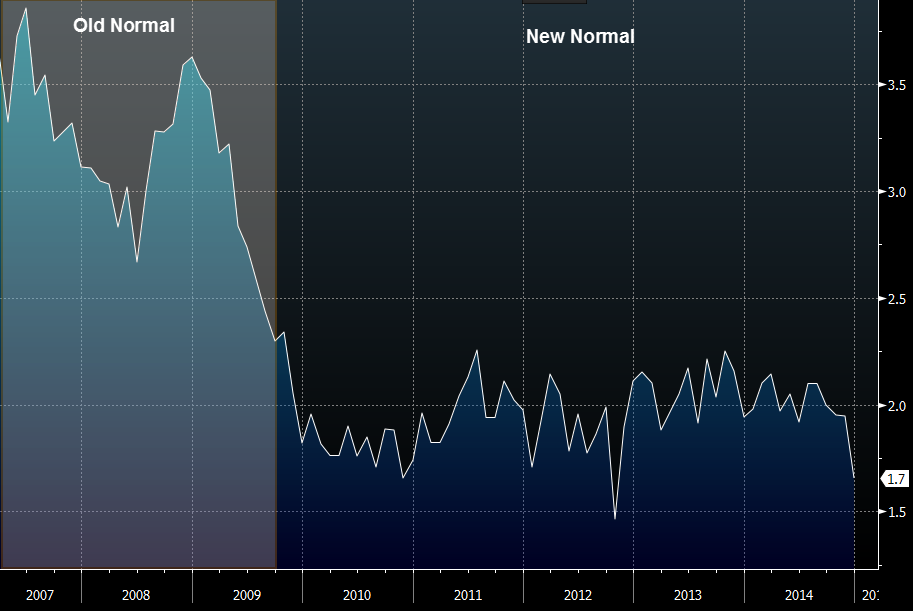

But there is a major caveat in the report — falling wages. Average hourly earnings declined 0.2% compared to a +0.2% reading expected. In year-over-year terms, wages were up 1.7% compared to 2.2% expected.

The Fed believes wage growth is coming because of a tighter labor market and that may eventually prove true but at the moment there is no urgency whatsoever and that gives the Fed more time to be patience before liftoff.

The US dollar is higher on the data but it may not be sustainable.

US wage growth y/y

Update: Bill Gross is making the same comments in a Bloomberg interview, saying wage growth isn’t enough to sustain growth and that the US should get used to wage growth of 2% or less.

Gross also says US yields to stay close to where they are now and that the Fed may hike 50 bps by year end.