The US dollars higher. Stocks are lower, and interest rates have increased especially in the shorter end:

Forex:

- The EURUSD move from 0.98742 the current level of 0.9835. The low reached 0.98118. The old low from September 6 at 0.9863 is now risk. Stay below keeps the sellers firmly in control. Another risk defining level comes in at 0.98745 – 0.98776. That area represents the swing low from September 5 and the swing low from September 7.

- The GBPUSD moved to a low of 1.12349. The price was trading at 1.1323 just before the rate decision. The current prices trading at 1.1270. On the downside, there is a trendline on the daily chart connecting recent lows down at 1.12208

GBPUSD moves to new low since 1985 and down toward trendline

- USDJPY moved to a high of 144.69. The price is trading at 144.23 just prior to the release. The pair still has the 145.00 level as topside resistance. That is just above the swing highs from September 7 and September 14. A close risk is at 144.20. The price is moving away from its 100 hour moving average at 143.45

USDJPY still below the 145.00 level

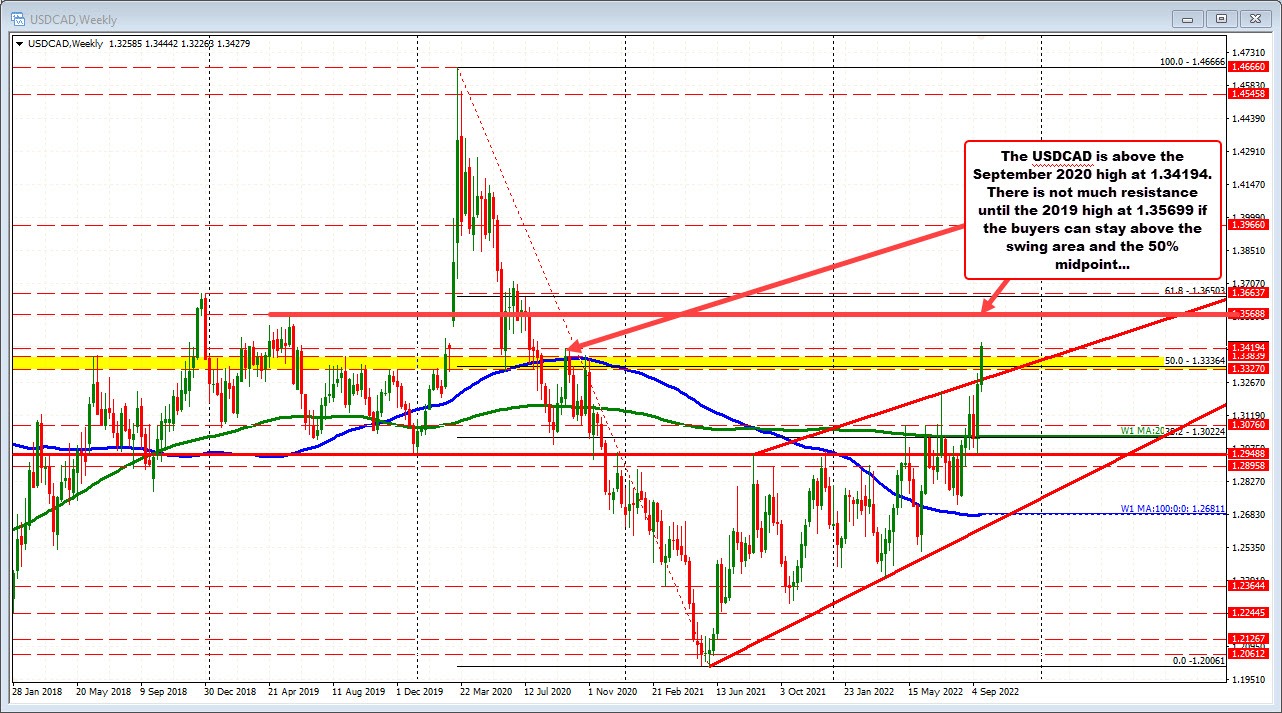

- USDCAD: The USDCAD was trading at 1.3387 just before the release. It is currently trading at 1.3434. The price has moved above the September 20, 2020 high at 1.34194. The price is moving farther away from the 50% midpoint of the range since 2021 33.364.

USDCAD above the September 2029

Looking at the stock market :

- Dow industrial average is currently trading down -210 points or -0.68% at 30495. The index is trading up 154.74 points or 0.50% just before the release

- S&P index is trading down -25 points or -0.66% the 3830.36. The index is trading up 26.43 points or 0.69% before release

- NASDAQ index is trading down 90.57 points at -0.79% 11334.98. The index is trading up 83.91 points or 0.73% at 11508.96 before release

In the US debt market, the yield curve has flattened with the shorter end moving higher

- 2 year yield is trading at 3.991%. It is currently trading at 4.076% up 11.0 basis point

- 10 year yield is trading at 3.577% up 1.0 basis points. It is currently trading at 3.561%, -0.6 basis points

- 30 year was trading at 3.582%, and currently trades at 3.530% down 4.4 basis points