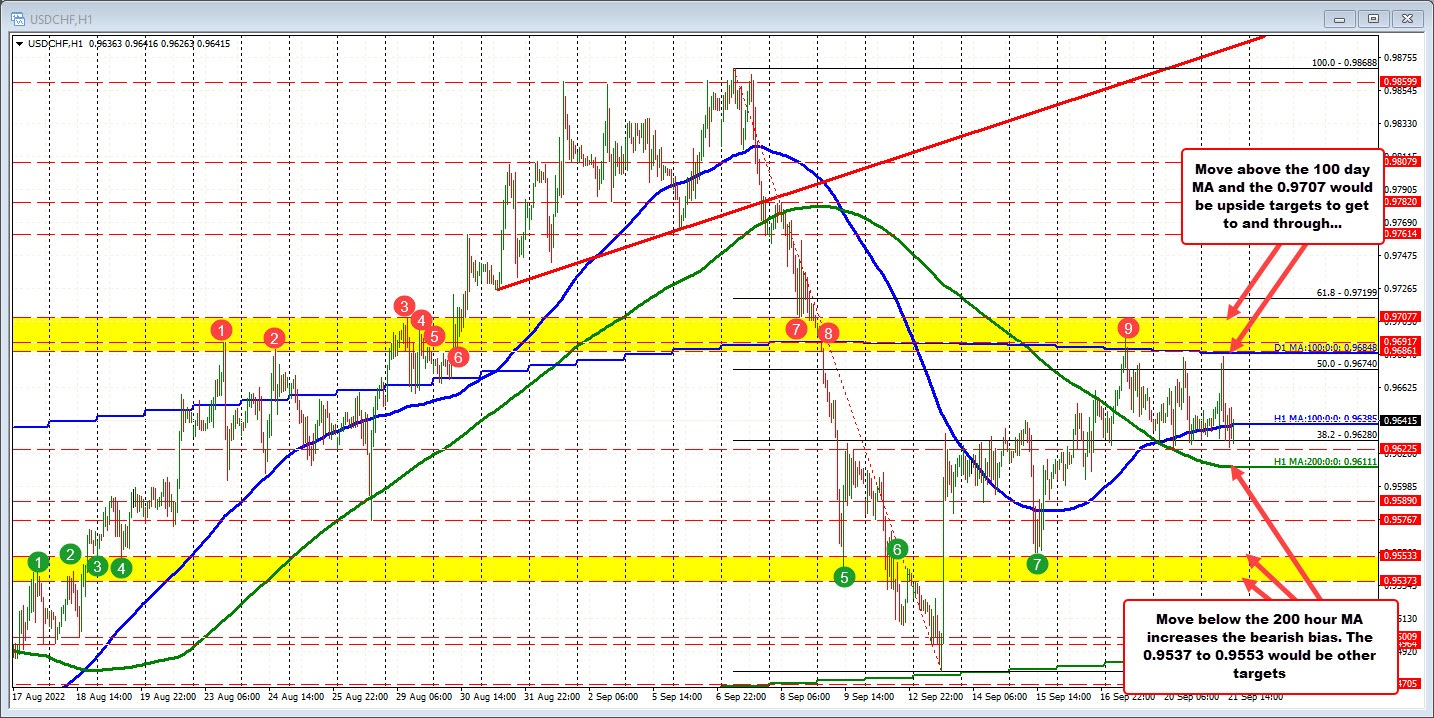

The USDCHF moved down to test the 200 day MA last week (green line) on September 13. The price bounced off the 200 day moving average and saw a push to the upside. The last 3 trading days have seen the price move up to test the higher 100 day moving average currently at 0.96848. The high price on Monday did briefly break above that level but quickly reversed back to the downside. The current prices trading at 0.9637. Through the FOMC decision, a move above the 100 day moving average would increase the bullish bias. Be aware.

Staying on the daily chart, on the downside, the 50% midpoint of the range for 2022 comes in at 0.95774. Moving below that level on the FOMC decision would tilt the bias more to the downside.

Drilling to the hourly chart, on the downside the 200 hour moving average comes in at 0.9611. During trading yesterday, the price low stalled against that 200 hour moving average increasing the levels of importance going forward. As a result, a move below 0.9611 would increase the bearish bias in the short-term. A break below that level would next target the 50% midpoint from the daily chart at 0.95774. Below that level and traders will be eyeing a swing area between 0.9537 and 0.9553 (see hourly chart below for key levels and why)..

Him