The US stocks have staged a run higher from the open with the Dow now down only 5 points . The Nasdaq has moved back above the 50% of the move down from the March 30 high at 12606 (barometer for buyers and sellers. See post here). It trades at 12660 currently.

That has the USD moving lower in sympathy with the exception of the USDJPY.

That pair is trading to a new session high on the day and in the process is breaking away from the 50% retracement of the move down frfom the July 14 high at 134.899. The USDJPY is usually very reactive to US interest rates. The 2 year is trading at 3.205% up 15.8 bps the high reached 3.25%. The 10 year is at 2.834% up 14.4 bps after reaching 2.849%

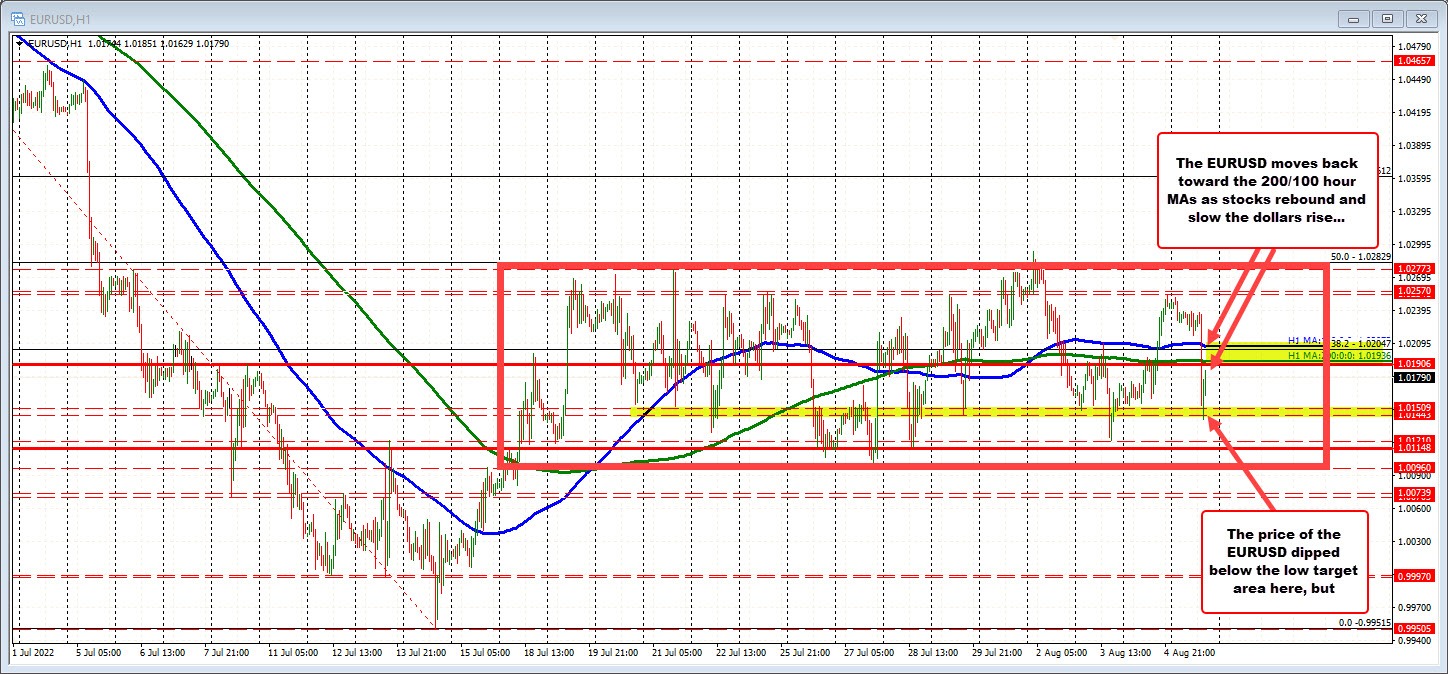

Meanwhile the EURUSD has seen a bounce back toward the 200 hour MA at 1.01936. The 100 hour MA is at 1.0208. The low reached 1.01409 and below a swing area between 1.0144 to 1.01509, but could not sustain downside momentum.

Dow has now turned positive. The S&P is just below unchanged and the Nasdaq is down -18 points or -0.16%. Wpw.