This is based on the probabilities of changes to the Fed Funds rate and U.S. monetary policy, as implied by 30-Day Fed Funds futures pricing data.

For the June meeting, later today on Wednesday, 14 June 2023 its showing 100% for no change, for Fed Funds to stay in the 5 - 5.25% range.

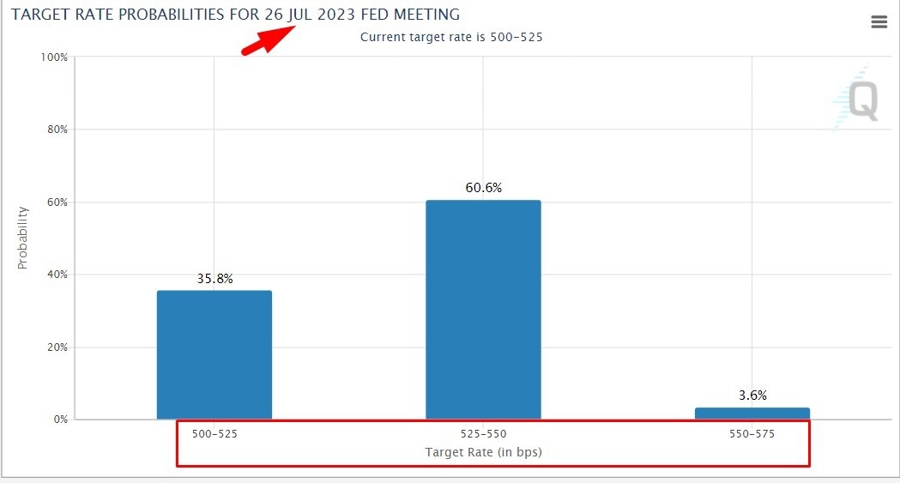

The July meeting, however, is still very much live at this stage:

By the time the July meeting comes around we'll have had another CPI reading for the US. This is likely to show inflation falling further, so I expect that pricing will move towards another 'no change' expectation. But, sticky core inflation is the question:

- BNP Paribas Federal Open Market Committee (FOMC) preview - why there'll be a hike in July

- Data on Tuesday showed US inflation kept slowing, should reinforce FOMC on hold decision (RBC preview)

- Goldman Sachs: FOMC likely to keep rates unchanged; dollar depreciation expected later

- Week Ahead: US CPI, FOMC, Retail Sales; ECB; PBoC, China activity data

Statement due at 2pm US Eastern time and Powell's news conference follows a half hour later.