Yesterday's Reserve Bank of Australia meeting was very much 'live'. While the consensus was for no change the rate hike didn't come as a shock. Recent wage rise info and inflation data (and even higher inflation data) were all sweat points for the RBA.

And so we got a rate hike:

- RBA surprises with 25 bps rate hike, cash rate raised to 4.10%

- Full statement of the RBA June 2023 monetary policy decision

Reserve Bank of Australia Governor Lowe will likely be addressing the decision in his comments today. If not in his speech then in Q&A. Bullock also perhaps.

The next focus for the session follows later, the data for China's trade performance in May. Speaking of sweat, China's bounce out of lockdown, or the dissipation thereof, is a point of concern. There have been some moves for stimulus from Chinese authorities, aimed for now at the property sector. Further monetary stimulus might be some way off according to this:

But there is some head-kicking going on:

- China calls on biggest banks to cut deposit rates to bolster the economy

- China regulator reportedly asks major state-owned banks to lower dollar deposit rates

- Pressure on the People's Bank of China "to keep policy loose and supportive"

Note: 'calls on' and 'asks' means getting a kick in the head in China.

There are some 'green shoots' though, not that this is getting too much exposure but its significant:

- ForexLive Asia-Pacific FX news wrap: China’s 2nd Manufacturing PMI beats, into expansion

- China Caixin / S&P Global non-manufacturing PMI for May: 57.1 (vs. expected 55.2)

Eyes will be on the trade data today to assess an improvement in the export sector and also to check out if domestic demand is bringing in more imports. ps. That 0300 GMT time for the Chinese trade data is approximate only.

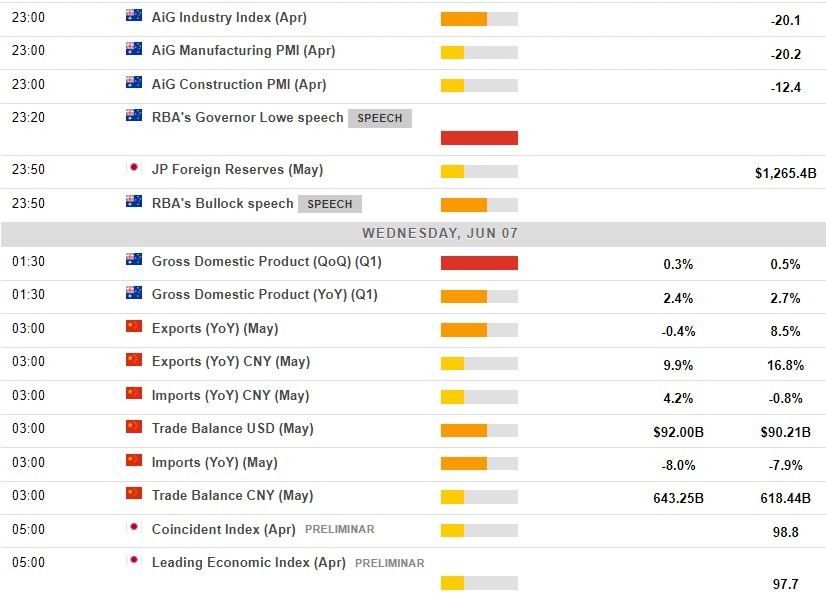

This snapshot from the ForexLive economic data calendar, access it here.

The times in the left-most column are GMT.

The numbers in the right-most column are the 'prior' (previous month/quarter as the case may be) result. The number in the column next to that, where there is a number, is the consensus median expected.