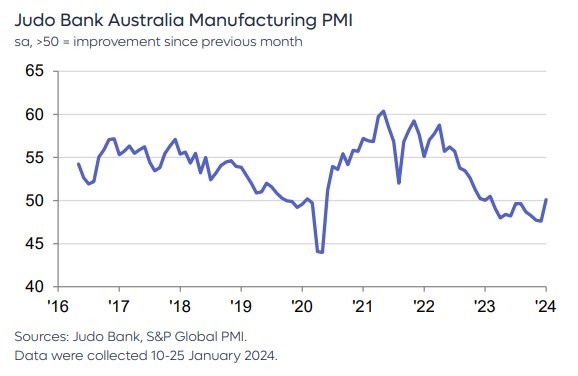

Australia S&P Global / Judo Bank Final January 2024 Manufacturing PMI has hit an 11-month high 50.1

- preliminary was 50.3, prior was 47.8 in December

Some of the commentary from the improved report, with a warning on inflation

- Over the past two months, the rise in the new orders index is the strongest in more than 18 months.

- Price indicators declined in January, suggesting further disinflation over the first half of 2024. Notably, the manufacturing input price index remains on the downtrend despite global and domestic shipping disruptions.

- A reasonably reliable relationship exists between the PMI Suppliers’ Delivery Times index and goods inflation in Australia. The recent fall in the delivery times index suggests that the disinflation of goods prices over the past 18 months has run its course.

- The current Suppliers’ Delivery Times index reading of 41.1 is broadly consistent with goods price inflation of around 4%, which is roughly where goods inflation was in November. The issue is that most forecasters had been expecting further goods price disinflation, if not outright deflation, as part of their overall Australian inflation outlook.

- This suggests that if supply chain disruptions in the shipping sector are sustained over the months ahead, the inflation outlook could be reassessed as goods price inflation proves to be stickier than previously thought.

- Overall, the first read on Australian manufacturing activity in 2024 shows a welcome improvement in activity and confidence, which points to the potential for a cyclical recovery over the course of 2024.