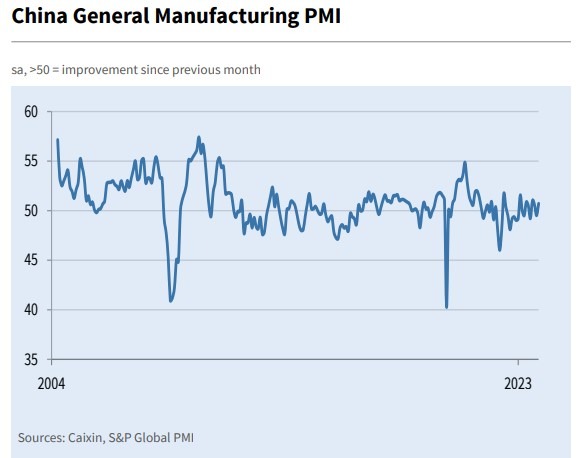

China November Caixin Manufacturing PMI comes in at a huge beat and much better than October:

50.7 to jump back into expansion

- expected at 49.8, prior 49.5

Yesterday we had the official PMIs, with manufacturing slipping even deeper into contraction

more to come

Key points in the report:

- Production returns to growth amid sustained rise in total new work

- Softer reduction in employment

- Business confidence ticks up to four-month high

Summary comments from the report:

- “Overall, the manufacturing sector improved in November. Supply and demand both expanded, prices remained stable, logistics improved, purchasing quantities increased, and manufacturers were more optimistic. However, external demand remained sluggish and employment weak, while manufacturers leaned toward caution in inventory management.

- “The macro economy has been recovering. Household consumption, industrial production and market expectations have all improved. But domestic and foreign demand is still insufficient, employment pressure remains high, and economic recovery has yet to find solid footing.

- “Policies should focus on expanding consumption, increasing income, promoting employment and stabilizing expectations. Considering that economic growth in the third quarter slightly exceeded expectations and the base number for fourth-quarter year-on-year growth is low, achieving the target of around 5% for the whole year looks attainable. Ultimately, policies should aim to lay a solid foundation for long-term economic growth and cultivate long-lasting market confidence.”

---

China has two primary Purchasing Managers' Index (PMI) surveys - the official PMI released by the National Bureau of Statistics (NBS) and the Caixin China PMI published by the media company Caixin and research firm Markit / S&P Global.

- The official PMI survey covers large and state-owned companies, while the Caixin PMI survey covers small and medium-sized enterprises. As a result, the Caixin PMI is considered to be a more reliable indicator of the performance of China's private sector.

- Another difference between the two surveys is their methodology. The Caixin PMI survey uses a broader sample of companies than the official survey.

- Despite these differences, the two surveys often provide similar readings on China's manufacturing sector. Not this month though, with the official manufacturing PMI in deep contraction while the Caixin is not.