The euro is trading at the highest since September 24 as it clears the October 11 high of 1.0640.

The rally today is more about the USD side of the equation as it slackens alongside Treasury yields. US 10s are trading at 4.86% from as high as 5.02% earlier today as part of a broad bid in bonds.

These moves came after 10s tagged 5% and Bill Ackman covered his well-publicized short on bonds. That's not exactly a strong fundamental backing for the bids in bonds but both Ackman and Bill Gross are arguing the economy isn't as strong as it looks. Right now the focus is on this week's Q3 GDP report but data from Q4 and beyond will start to add up soon. Higher long-term rates are a big drag for things like housing, autos and corporate investment.

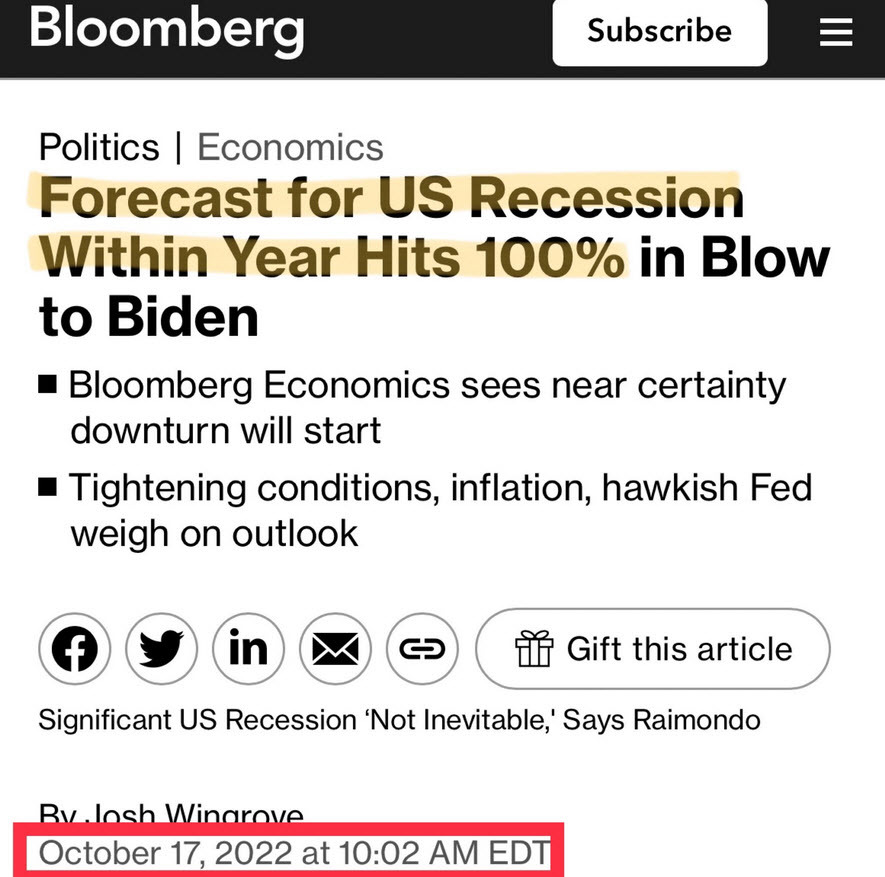

At the same time, a year ago there was an overwhelming consensus that a recession was imminent.

So do you make the trade based on expectations that a recession will come or do you want to see some harder data first?

There are a wave of corporate earnings reports this week and some of the companies have great insight into what's happening in the economy right now and what's changing. So far, banks have been reasonably upbeat so I'm skeptical about a Q4 recession so I don't think this move has legs.

Meanwhile, the EUR side of the equation is vulnerable to continuing economic underperformance. Germany is already in a recession and will contract further in Q4. There's a good chance that the ECB will be one of the last to finish hiking but also one of the first to cut.