- US major indices close mixed. NASDAQ higher for the third day in a row

- Canada plans to ban imports of Russian crude oil

- White House: A no fly zone would be step toward sending US troops to fight a war w/Russia

- US State Dept: US will do more on sanctions as it has seen no de-escalation from Russia

- Yields continue their move lower

- Can Russia Avoid the SWIFT Blockade?

- WTI crude oil future settle at $95.72

- Signs increasingly point to goal of Russian regime change. Beware the consequences

- Sprint out of Russian oil and gas highlights acute risk of under-investment

- Ukraine Podolyak: Russian side is still extremely biased

- European major indices close lower on the day but near session highs

- Russia-Ukraine talks seem to be headed towards a second round

- Fed's Bostic: Today I am in favor of 25 bps hike in March

- Russian stock market may be closed, but ETFs are being marked sharply lower

- Dallas Fed manufacturing business index 14.0 vs 2.0 prior

- Putin to Macron: Russia is open to talks with Ukraine and expects them to lead to results

- French Pres. Macron spoke with Russia's Putin and urged an immediate cease-fire.

- Ukraine Foreign Minister: Ukraine not ready to surrender or capitulate to Russia

- OPEC+ set to deliver 400k bpd increase, as planned - report

- Canada IPPI for January 3.0% versus 0.9% estimate

- US advanced goods trade balance 107.63B vs 100.4B last month. New record

- WSJ: US/Other major oil consuming nations consider releasing 70M barrels from SPR

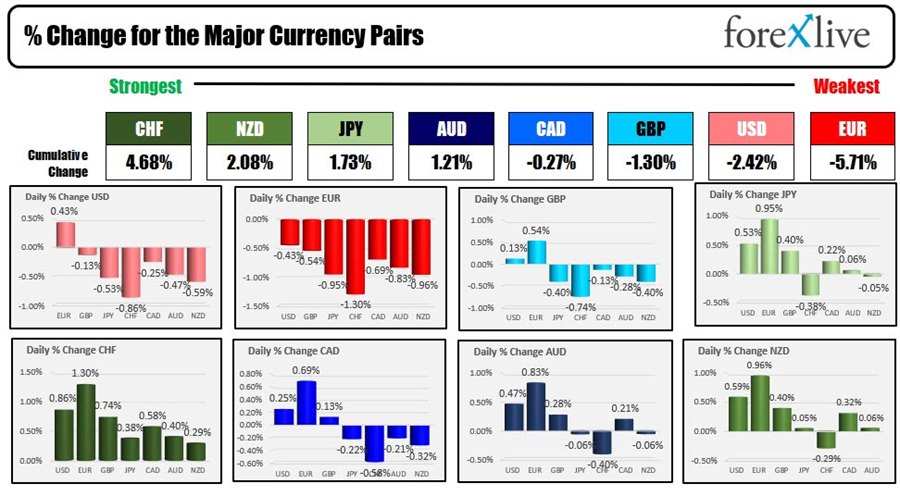

- The CHF is the strongest and the EUR is the weakest as NA traders enter for the day

The bad news today was the Russian Ukraine talks ended with little progress. The good news is that they seem to be heading for a 2nd round.

Today (and over the weekend) US and NATO allies continued to tighten the screws via additional sanctions directed toward leaders, and businesses, financial institutions and Russia's central bank including the partial denial of service from the SWIFT system.

The SWIFT system links world banks which is a secure way for banks to transmit transfer requests. Without it trade is hugely impacted.

Oil companies including BP, Total and Shell each look to end joint ventures with Russian companies, shutting down investments into their gas and oil exporations.

The sanctions against the Russian central bank prevents the government from moving its assets held abroad and thus using its emergency reserve currencies to protect it's economy from the NATO's campaign.

Those measures sent the RUB tumbling lower. The USDRUB closed on Friday at 83.90 and is currently trading at 106.47. That is a devaluation of the RUB of 26.9%. A lower currency increases inflationary pressures in the country while asset prices are tumbling.

The Russian stock markets were closed today and will remain closed tomorrow. However, looking at some ETFs and stocks trading in the US and London, show priced down by hefty amounts (see some ticker symbols below and their changes on the day). Ouch.

As if that was not enough, in effort to slow the selling of the RUB, the central bank instituted capital controls and also raised their benchmark interest rate from 9.5% to 20.0%.

All that is bad news for Russia, but they continued their convoy to Kyiv and Putin for the 2nd time, threatened with nuclear retaliation. They could also engage in a massive cyber attack that if successful, could cripple the US and other NATO countries if successful.

The stakes are still high and likely to continue for a while still.

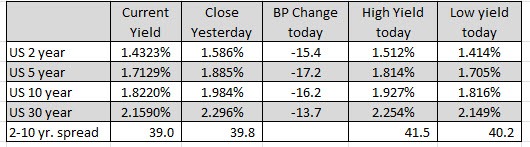

IN the markets, the news sent flight to safety flows into the debt instruments.

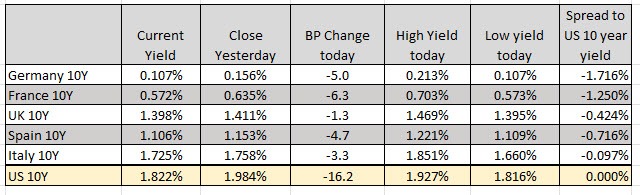

The benchmark 10 year yields in Europe closed lower with France and German rates down -5.0 and -6.3 bps respectively.

The move lower in the US was even more pronounced with the 5 year yield tumbling by some 17 basis points and it's benchmark 10 year yield down -16.2 basis points on the day.

In the US stock market, the major indices closed mixed with the Nasdaq higher (the Russell 2000 was higher as well), while the Dow and S&P were lower (although well of the lows for the day). In Europe, major indices were lower with indices closing down -0.1% to -1.40%, but were well off lows which reached to -3.0 to -3.5% in the German Dax, France's CAC, and Italy's FTSE MIB. Below are the highs and lows and closes for the major US and European stock indices.

In the forex market today, the flow of funds moved into the relative safety of the CHF (the CHF was the strongest of the major currencies), and out of the EUR (economy most tied to Russia as well as being geographically closer) and USD (on the lower rates).

Some technical levels to eye in the new trading day:

- EURUSD: The EURUSD moved to a new session high in the NY session but stalled against its 100 hour MA at 1.12403 currently. The pair is trading at 1.1215 at the close. Staying below the 100 hour MA in the new trading day will keep the sellers more in control

- GBPUSD. The GBPUSD gapped lower but is closing the day near highs at 1.3425. The high price reached 1.3430. The falling 100 hour MA is at 1.3455 going into the new day. A move above the Friday high at 1.3439 and then the 100 hour MA (at 1.3455) is needed to increase the bullish bias in the new day. Absent that, and the a rotation back down would be in the cards

- USDJPY: The USDJPY fell below its 100 and 200 hour MAs at 115.207 and 115.116 respectively in trading today. A move above those levels would be needed to increase the bullish bias.

- USDCHF: The USDCHF is closing back below it's 200 day MA at 0.9182. The pair is trading at 0.9169 at the end of the day. Stay below in the new trading day will keep the sellers more in control.

- USDCAD: The USDCAD fell back toward the low of the up and down swing area near the 1.2649 to 1.2656 (see red box on the chart below). That move came after the pair tried for the third time in as many days to extend above the topside swing area above 1.27956. The tumble lower saw the pair move below the 100 and 200 hour MAs on the way lower. In the new trading day a move below 1.26496 will increase the bearish bias.