- Bitcoin can't keep upside momentum going

- Macron-Le Pen debate is underway

- WTI June crude oil contract settles at $102.19

- Fed's Daly: The case for 50 bps hike is 'now complete'

- Beige Book: Economic activity expanded at a moderate pace

- Outside day shaping up in long bonds

- U.S. Treasury auctions off $16 billion of 20 year bonds at a high yield of 3.095%

- European equity close: German stocks lead in a strong day

- Fed's Daly: It's prudent to hike to 2.5% by year-end

- Latest poll puts Macron at 55.5% ahead of today's debate

- Evans: The Fed will be at neutral by year end

- US EIA weekly oil inventories -8020K vs +2471K expected

- Methodology change helped to boost Canadian CPI above expectations

- US March existing home sales 5.77m vs 5.80m expected

- ECB's Nagle: Returning to ECB's targeted 2% inflation rate looking ever less likely

- Canada March CPI +1.4% vs +1.0% m/m expected

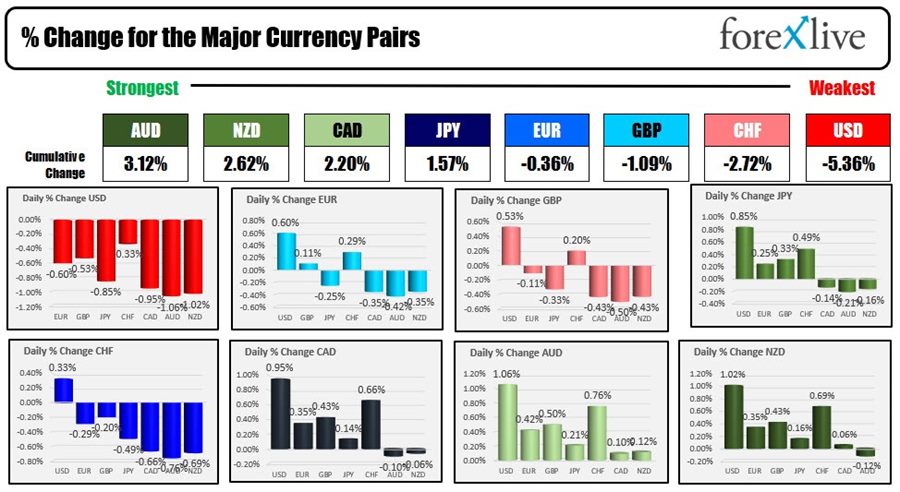

- The AUD is the strongest and the USD is the weakest as NA traders enter for the day

- ForexLive European FX news wrap: USD/JPY air pocket weighs on the dollar

The USD corrected lower today after the dollar index (DXY) moved to the highest level since moved to the highest level since March 20 yesterday. That move was certainly helped by the rise in the USDJPY which coming into today, closed higher for 13 consecutive days.

The USDJPY extended to a new cycle high today (and highest level since May 2002) before moving lower (JPY higher). The AUD, NZD and CAD also moved solidly higher vs the greenback, with each of those currencies advancing by close to 1% on the day.

The USDCAD fell -0.95% after Canada CPI inflation was higher than expectations (although a methodology change did help boost the number this month) and moves the expectations for the Bank of Canada to hike by 50 basis points at their next meeting.

In other news today, the US existing home sales came in slightly weaker than expectations and more comfortably below the 6 million annualized sales pace. The high annualized pace for the series reached about 6.65 million. The full impact of the surging mortgage rates up toward 5.25% have not been fully realized yet. Higher prices and higher rates are a formula for a slowing housing market going forward

Fed's Evans and Daly both spoke and solidified the 50 basis point rate hike at the Fed's next meeting (there is no debate now). They also reiterated the need for the Fed funds rate to be near the neutral rate by year-end which many see as 2% to 2.5%.

The Fed's beige book said that economic activity expanded at the moderate pace with inflation remaining strong across all districts.

Below is a look at the strongest to weakest of the major currencies. The AUD was the strongest and the USD was the weakest.

The US stock market closed mixed with the Dow industrial average outperforming the broader indices as Netflix's tumble impacted the NASDAQ index in particular (Netflix closed down a whopping minus hundred and $22.39 or -35.14%):

- Dow industrial average rose 249.59 points or 0.71% at 35160.80

- S&P index fell -2.76 points or -0.06% at 4459.46

- NASDAQ index fell -166.60 points or -1.22% at 13453.06

- Russell 2000 somewhat surprisingly rose 7.4197 points or 0.37% at 2038.18

In the US debt market, yield declines were a catalyst for the lower greenback. The 20 year bond auction of $16 billion was a strong with very strong international demand (record level). A look at the changes for the day shows

- 2 year 2.577%, -1.9 basis points

- 5 year 2.862% -5.6 basis points

- 10 year 2.832%, -10.8 basis points

- 30 year 2.869% -12.9 basis points

In other markets,

- Gold had a down and up trading day, with the price trading near the highs at the close help by the lower rates and the lower dollar

- The price of bitcoin is closing marginally lower after running up to test its 38.2% retracement of the most recent move to the downside. The current price is trading at $41,330 down -$174 on the day

- In the oil market today, the weekly inventory data showed a much stronger than expected drawdown of about -8 million barrels (was expecting a build of 2.5 million or so. Nevertheless the price moved lower breaking below the $100 level briefly before rotating back to the upside. The current price is trading at $102.56 that's up $0.51 on the day or 0.5%.