The euro couldn't hold above 1.12 in September or August and now the market is rethinking the idea of global rates converging at low levels. That's left the euro in a vulnerable spot with Goldman Sachs saying it should now be the preferred funder.

The ECB will almost-surely cut rates tomorrow and the market is pricing in an ongoing cycle of cuts down to 1.75% in late-2025. That has the euro down another 30 pips to 1.0861 today.

The main problem for Europe is the economy. It's been a struggle to generate growth and the major nations are facing tough decisions on deficits that make domestic politics untenable and unstable. In addition, the bureaucratic overhang is a major handicap and one that Macro warned earlier this month was potentially fatal.

“Our former model is over. We are overregulating and underinvesting. In the two to three years to come, if we follow our classical agenda, we will be out of the market,” he warned.

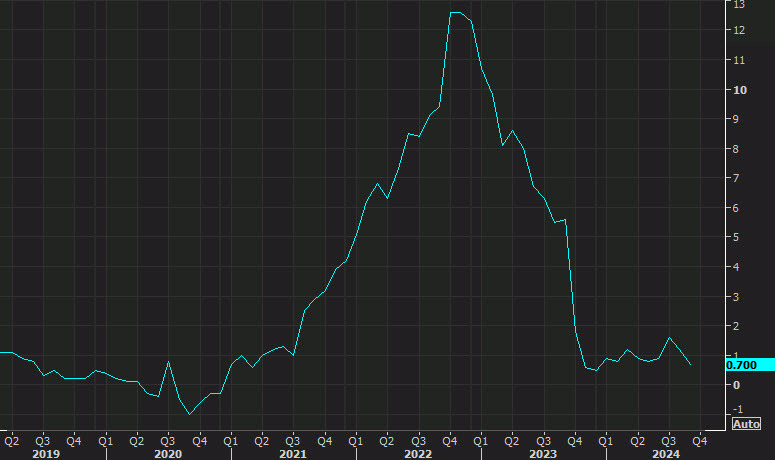

The ECB also looks behind the curve as French CPI falls to 1.4%, Spanish CPI to 1.5% and Italian CPI to 0.7% y/y.

The risk is that by acting too slowly, the eurozone locks in another period of below-target inflation that eventually results in rates being pinned to the floor. That's coming at a time where it looks like the US will engineer a soft landing that leads to a higher plateau in inflation.

It's not all dismal though, the German DAX hit a record yesterday despite the energy crisis and manufacturing squeeze. Expectations are low in Europe and valuations are cheap. There is a well-educated workforce and some dynamic economies, but politicians need to act with the type of urgency that Macron is arguing for.