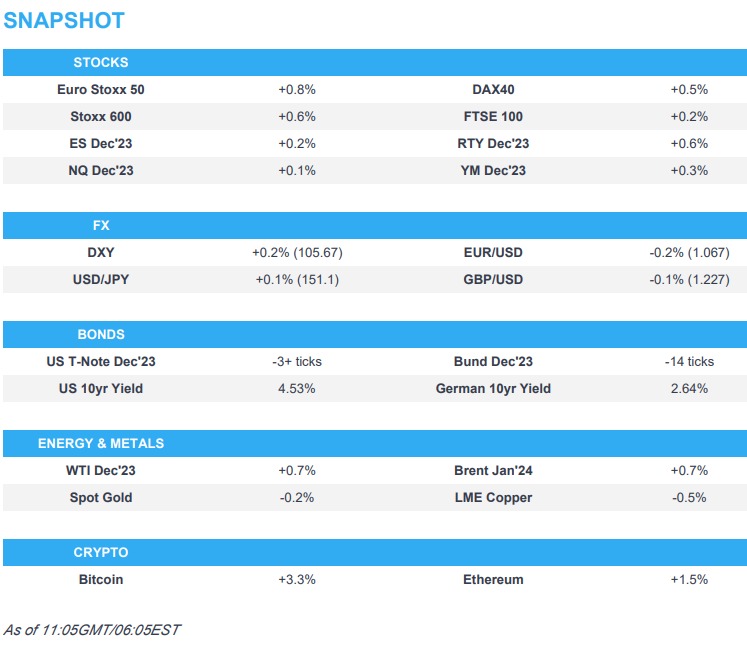

- European bourses march firmly into the green whilst US futures post gains to a lesser extent; RTY outperforms after heavy losses in recent sessions

- Dollar is firmer ahead of Fed Chair Powell, with the Kiwi outperforming as it benefits from AUD/NZD cross-selling

- Debt gives back some of the prior session's gains with US 10-year yield surpassing 4.50%, though benchmarks are off worst

- Crude attempts to claw back some of the losses felt over the week; potentially assisted by news that the US military conducted strikes in eastern Syria

- Highlights include US IJC, NZ Manufacturing PMI, Speeches from Fed’s Powell, Barkin, Bostic, ECB’s Lagarde, Banxico Policy Announcement, Supply from US