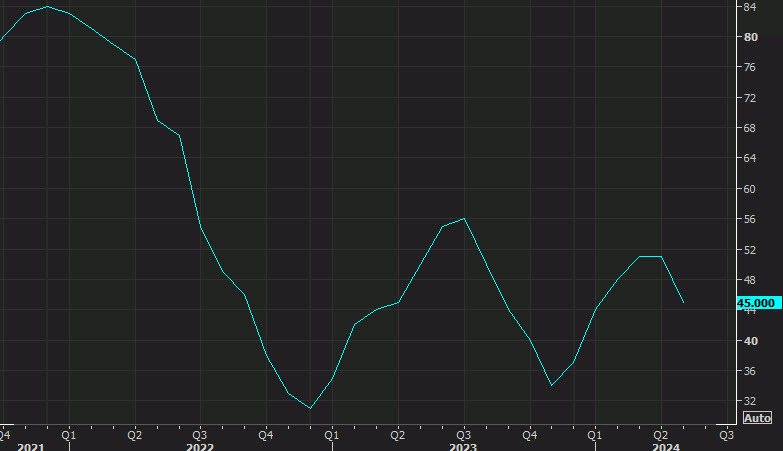

- Prior was 45

- Current sales 48 vs 51 prior

- Six month sales 47 vs 51 prior

This is the lowest reading since December. It's the second consecutive miss in a quick fall from 51 in April. The latest retail sales data also showed poor metrics on building materials and furniture, which are proxies for housing turnover.

Here is what US home builder Lennar said in its conference call yesterday (shares fell to the lowest since Jan):

Overall, the macroeconomic environment remains relatively constructive for homebuilders. There are challenges and there are opportunities. The demand for housing remains strong, limited by affordability, interest rates and sometimes wavering consumer confidence. Additionally, the chronic housing shortage driven by over a decade of underproduction of housing stock is additionally problematic for families seeking affordable or attainable supply. Demand remains robust if it can be supplied an attainable price point, with interest rate support that enables the consumer to transact.

Through our second quarter, interest rates started lower and felt constructive at approximately 6.75% as the market was adjusting to a new name. Then for the quarter, rates began a gradual climb to 7.3% before dropping again as the quarter ended. Concurrently, consumers remained employed. They are confident that they will remain employed and they believe that their compensation will rise as well. This is most often the foundation of a very strong housing market but the chronic supply shortage, the impact of interest rates on affordability as well as persistent and stubborn inflation have moderated housing market strength.