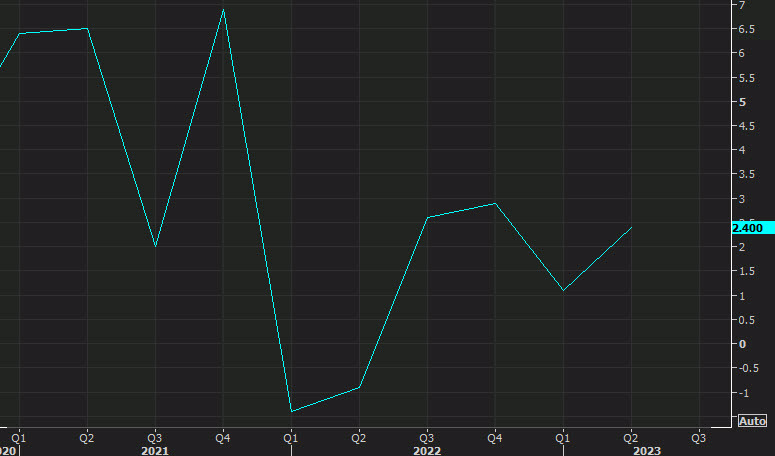

- Final Q2 reading was +2.4% annualized

- Q1 was +2.0% annualized

- Best quarter since Q4 2021

- Estimates ranged from 2.5%-6.0%

Details:

- Consumer spending +4.0% vs +0.8% prior

- Consumer spending on durables %

- GDP final sales +3.5% vs +4.5% expected (+2.3% prior)

- GDP deflator 3.5% vs +2.5% expected (+2.2% prior)

- Core PCE +2.4% vs +2.5% expected (+3.8% prior)

- Exports +6.2% vs -9.3% prior

- Imports +5.7% vs -7.6% prior

- Business investment +8.4% vs +5.2% prior

Percentage point changes:

- Net trade -0.08 pp vs +0.04 pp prior

- Inventories +1.32 pp vs 0.0 pp prior

- Govt +0.79 pp vs +0.57 pp prior

The final Atlanta Fed GDPNow tracking estimate for GDP was +5.4%.

The inflation metric is stale but it's surprisingly high and the market isn't sure how to read that because it could mean that Q4 inflation is lower or could be a sign of stickier inflation.