Cites lower commodity prices and a rising AUD. What levels are in play for the AUDUSD.

There is a piece on the Business Insider outlining Daniel Breen's - ANZ currency strategist - case for the RBA to change the tone on the AUD back to the dovish side (CLICK HERE for the full article)

In the article Breen says that although "there will be little change in its tone around the domestic economy", that there is "some chance that the RBA shifts its language on the AUD once again". His argument is that the AUD has risen over the past two months despite a 20% plunge in the spot iron ore price. Iron ore represents 34.7% of the RBA's commodity price index.

Breen points out that given the AUD rise the 20% fall in iron ore price has knocked around 7% off the index.

As a result, he believes it would be appropriate for the RBA to say something like:

"The recent declines in commodity prices makes further depreciation in the AUD seem likely"

Be aware. It could send the AUDUSD back lower.

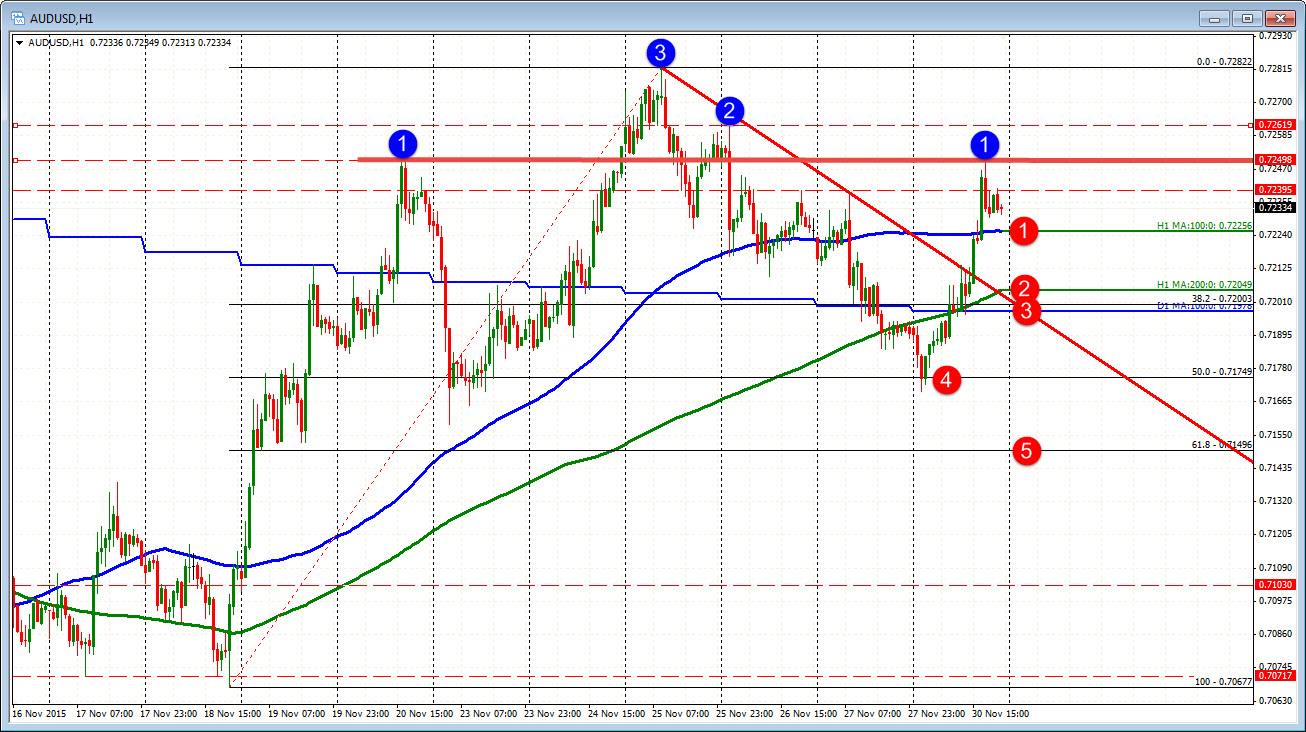

Technically for the AUDUSD, the pair rallied higher on more favorable technicals today (see prior post) but stalled at the November 20 high. The move higher methodically took out the

- 100 day MA at the 0.7198 (red circle 3),

- the 200 hour MA (green line in the chart above) at 0.72049 (Red circle 2)

- The 100 hour MA at the 0.7225 (red circle 1)

Each of these levels will/should be broken if Breen is right with his thoughts, and if so, then become resistance levels on corrections. Further to the downside is the 50% of the move up from the November 18 low which currently comes in at 0.7174 (red circle 4). The 61.8% is at 0.7149 (red circle 5)

If the RBA is not so dovish, the next closest targets include:

- 0.7250. High from November 20 and today (the high today was 0.7249)

- 0.7262. High from Nov 26th

- 0.7288. High from Nov 25th and the highest price since October 23rd.

Above that and trend line resistance comes across at 0.7331 on the daily chart below. Above that at the high from October and 38.2% of the move down from May 2105 high comes in at 0.7380. This is a key level and target.

The decision and statement will be made at 10:30 PM ET/0330 GMT.