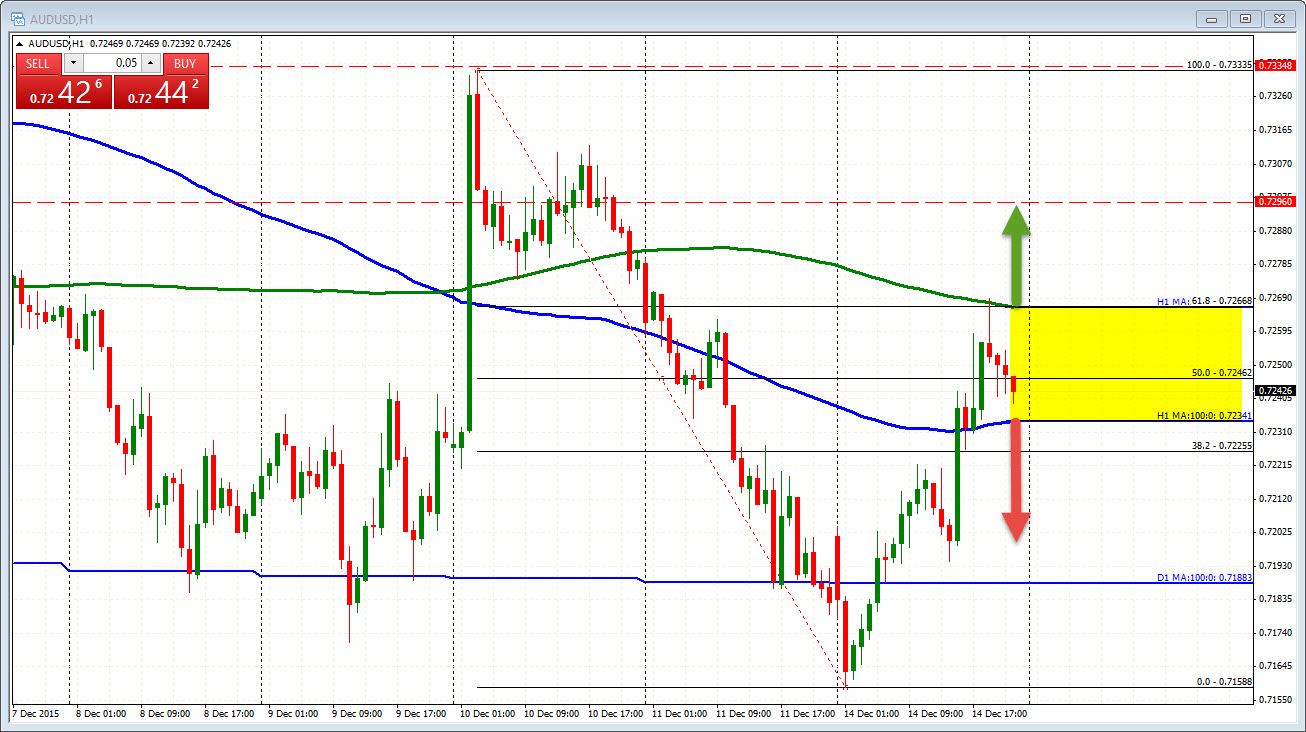

Held the 200 hour MA. Worked back to the 100 hour MA

The AUDUSD rallied higher in trading today but ran into resistance against the 200 hour moving average (green line in the chart below) and 61.8% retracement of the move down from last week's high (at 0.72668). The pair has wandered lower since then but has not been able to get down to the 100 hour MA support ( blue line in the chart below, currently at 0.72341). I call this trading between the goalposts as defined by the 200 bar moving average and the 100 bar moving average. Look for a break with momentum.

Looking at the daily chart, there is another key level that should the price start continue the momentum to the downside. Specifically, the 100 day MA (blue line in the chart below) at the 0.7188 level could be in play in the new trading day. On Friday, the price close below that moving average for the 1st time in December, but despite a lower low today (in fact, the low was the lowest low since October 23rd), the momentum could not be sustained and the price moved higher. This might be a clue that buyers are nibbling at lower levels.

As the clock ticks toward the Asia-Pacific session, there will be some Australian news released. Specifically, the monetary policy meeting minutes will be released (SEE Eamonn's preview by clicking here) along with the quarter on quarter home price index for the 3rd quarter (est 2.1% vs. 4.7% in the 2Q) and data on new motor vehicle sales.

Also of note this week is that Reserve Bank of Australia Gov. Glenn Stevens is expected be interviewed by the Australian financial review (see Eamonn's post from last week). He has given interviews the last three years and they tend to be in depth. So be on the lookout.