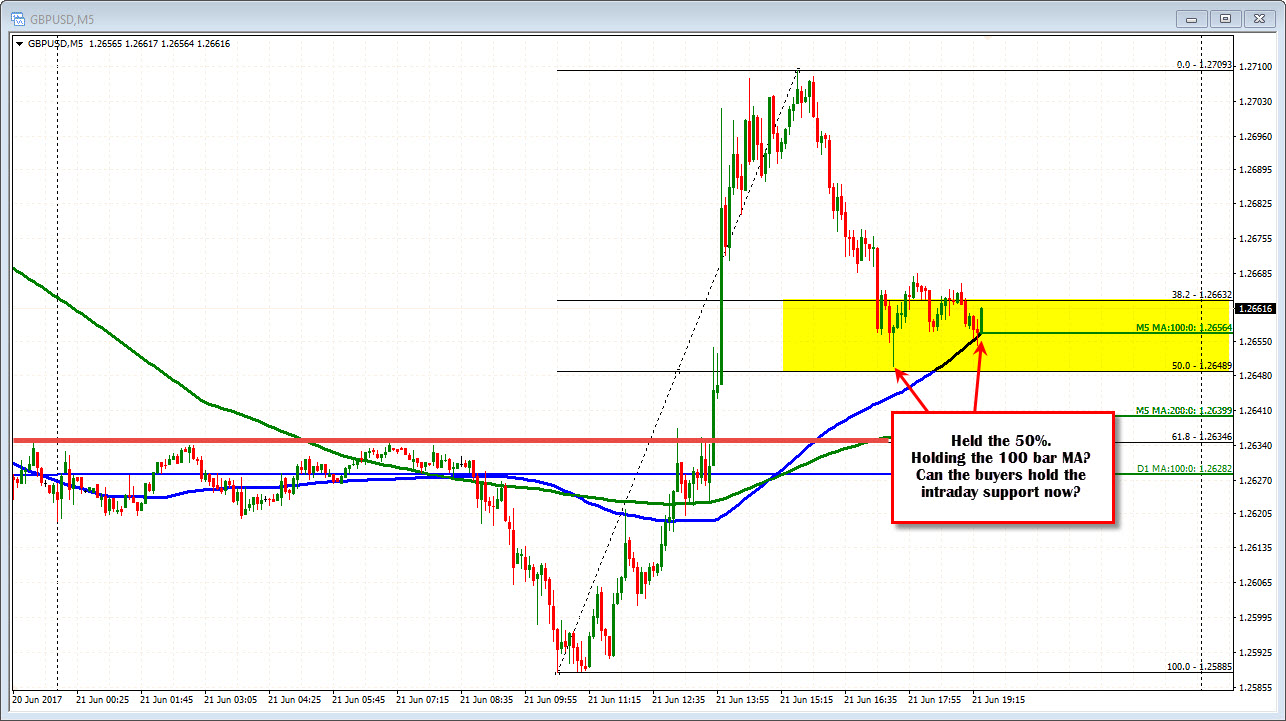

Intraday support at 50% and now the 100 bar MA trying to stall the fall.

The GBPUSD started the NY session near the 50% retracement. Lots of resistance was above at the 100 and 200 hour MAs (and old lows) at the 1.2224 area (see earlier post).

The price started to come back down and retraced most of the move up from the Haldane comments. On the move down, the price has reached the 50% of the day's range and stalled. The 100 bar MA is now being tested on the 5- minute chart.

Will the buyers now come in against that intraday level? If the area can hold there could be a rotation back toward the highs. I am not expecting new highs but could see a 20-30 pip wander. If the 1.2648 level is broken, could head lower (risk for longs).

Just an thought give the price action.