Month end may be an influence at fixing time

The EURUSD is moving back lower and trades at new session lows. The 4 pm London fixing may play a part. There is some speculation that since it is a UK holiday on Monday, the month end fixing might be in play early. It seems that might be in the direction of dollar buying (EURUSD selling). Indeed at 11 AM the low levels was printed.

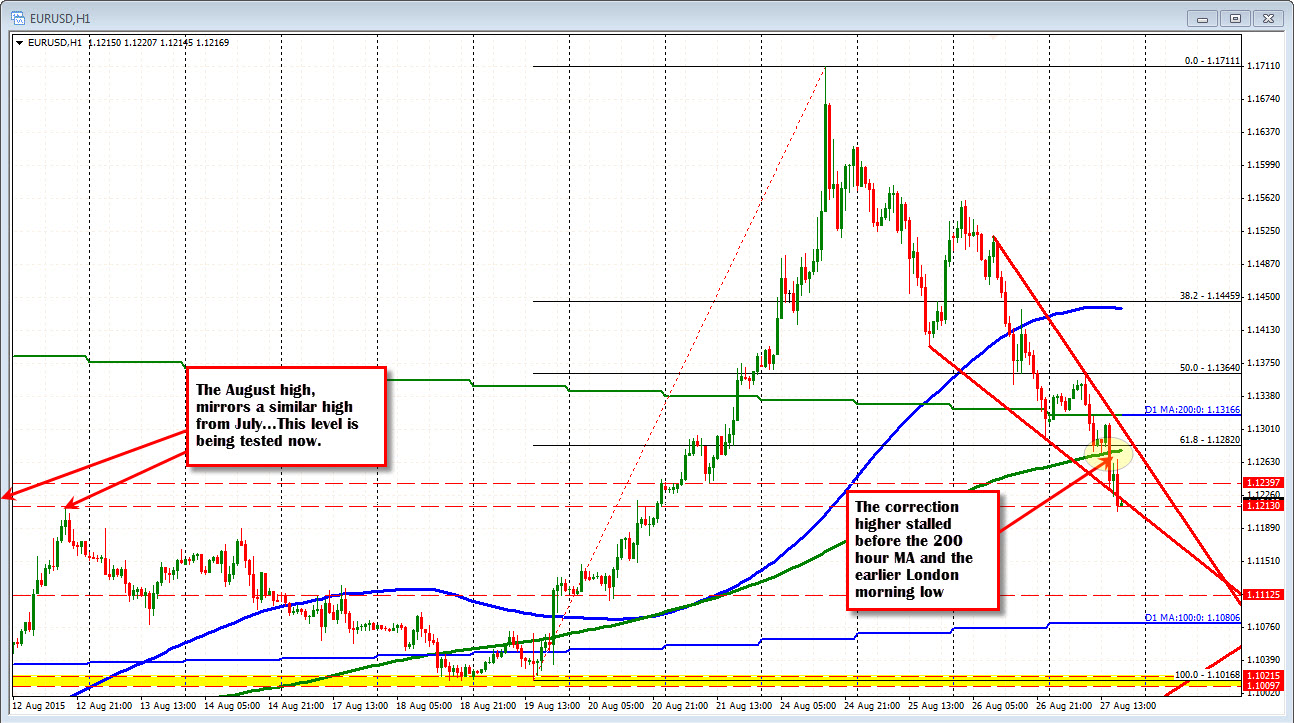

The EURUSD rallied up after the Pending Home sales data and moved above the minimal level at the 1.1240. The next target was the 38.2-50% retracement of the NY session move lower (see prior post) at 1.1256-65. That level held and seller reentered. Stocks have been moving back higher which - along with the fixing - may also be an influence.

The pairs low was reached just as the London fixing came and went. Also at that time the Kansas City Fed Mfg index did come out weaker at -9 vs. -4 but that series is not usually a market mover. In any case, the dip low was seen a rebound and we are back looking toward that 1.1240 level as the minimum level that the buyers will have to take the price if the low is NOW set. .

Like previously, a move above 1.1240 (which was a minor corrective low from August 21), the focus will be the 1.1265 and then the 200 hour MA at the 1.1277 level (moving a touch higher after each hour). The 200 day MA is another key level above at 1.13167.