EURUSD holds 100 day MA. GBPUSD shows some signs of a top for the day.

The dollar selling is showing signs of slowing as the day moves to a close.

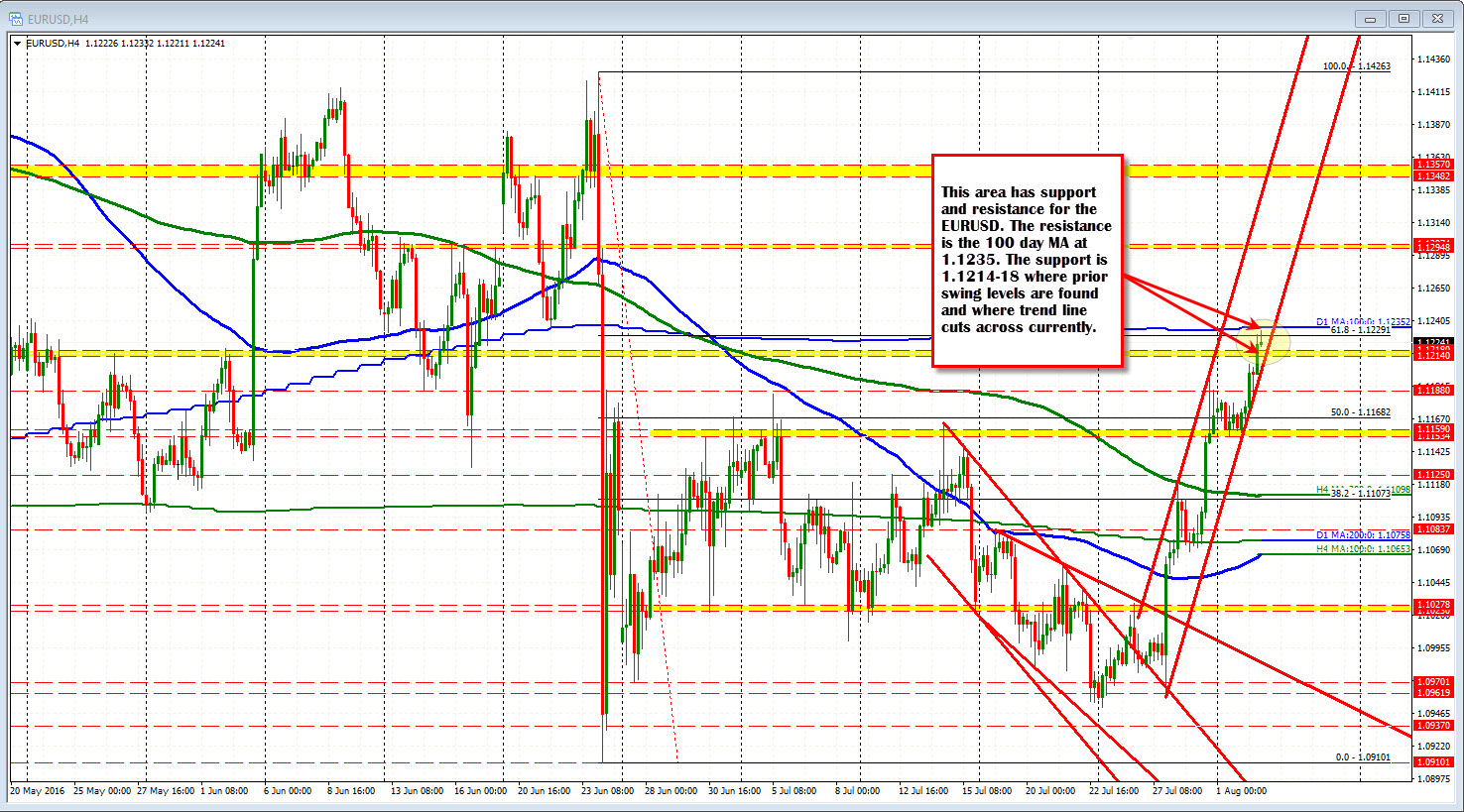

EURUSD.

The EURUSD went right up to the 100 day MA at the 1.1235 level and stalled. The price is back to the low 1.1220's currently. Staying below the 100 day MA is the shorts risk. Of course traders who are long oh so wanted to see what was above the 100 day MA, but did not get that chance (i.e. stops being triggered). Close support will be eyed at 1.1214-18 going forward. If the 100 day MA is it for the rally a move back below that level will be eyed by traders.

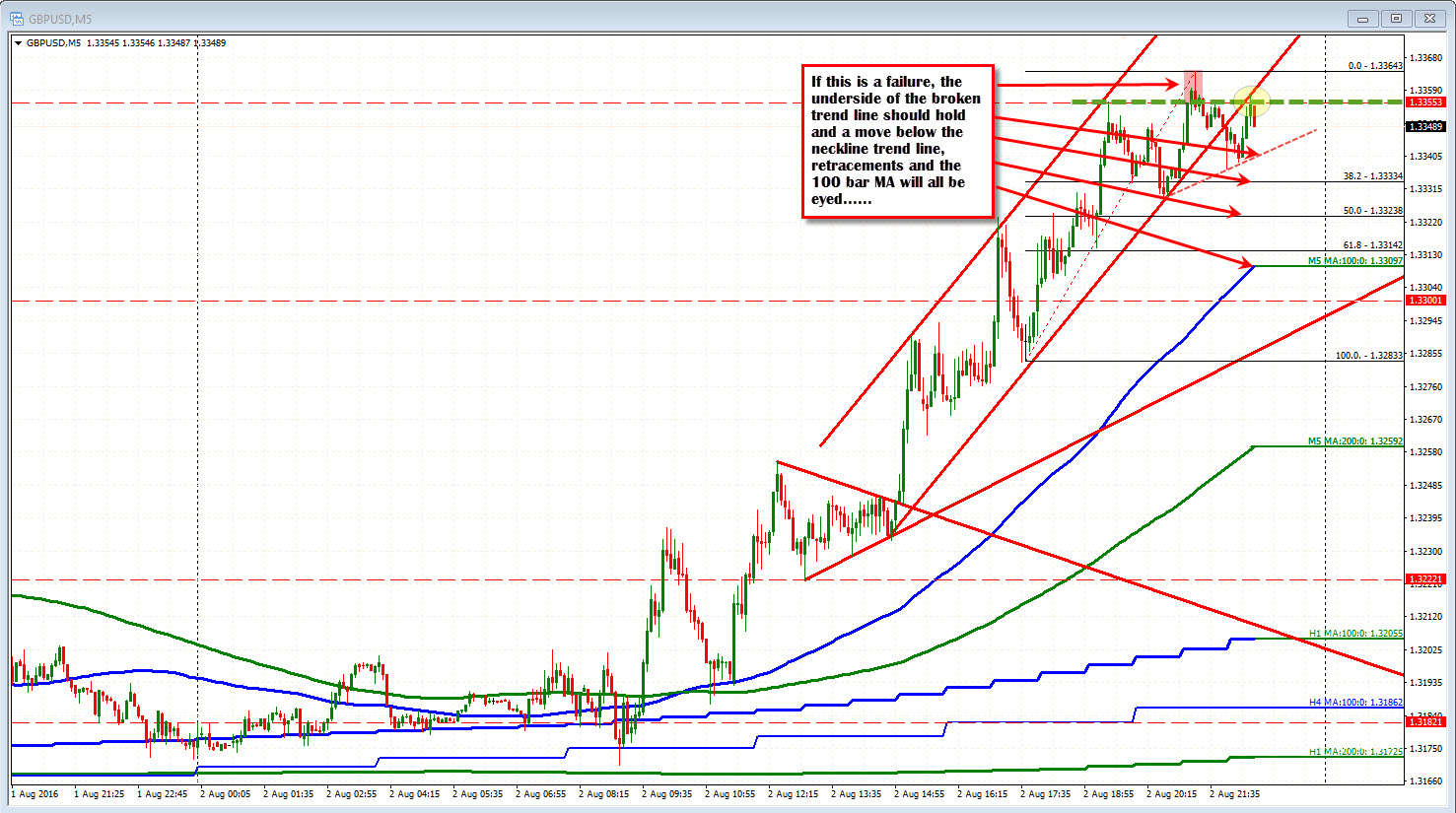

GBPUSD.

The GBPUSD raced higher today despite the expectations that the BOE will cut rates later this week (Thursday). The move to the upside has been steady with corrections being bought. The pair did break below a lower channel trend line and the topside momentum seems to be fading. The price is also just now testing the underside of that broken trend line at 1.3357. If there is a reason to sell, it would be against the underside of the trend line with a stop above (forming a head and shoulder in the process). If it does hold, there are a lot of support levels to get below including the neckline of the forming head and shoulder, the 38.2% and 50% retracements pof the last trend leg higher at 1.3333 and 1.3323 respectively, and the rising 100 bar MA (blue line in the chart above) which currently comes in at 1.33097..

USDJPY

My view of the USDJPY shows a potential failure of a broken trend line at the 100.79 level (currently). That trend line connected lows from July 26 and July 29th. There were two hourly bars with closes below. The last three hourly bars have closed above. If there is to be a correction after the failed break, this would be the risk for the longs.

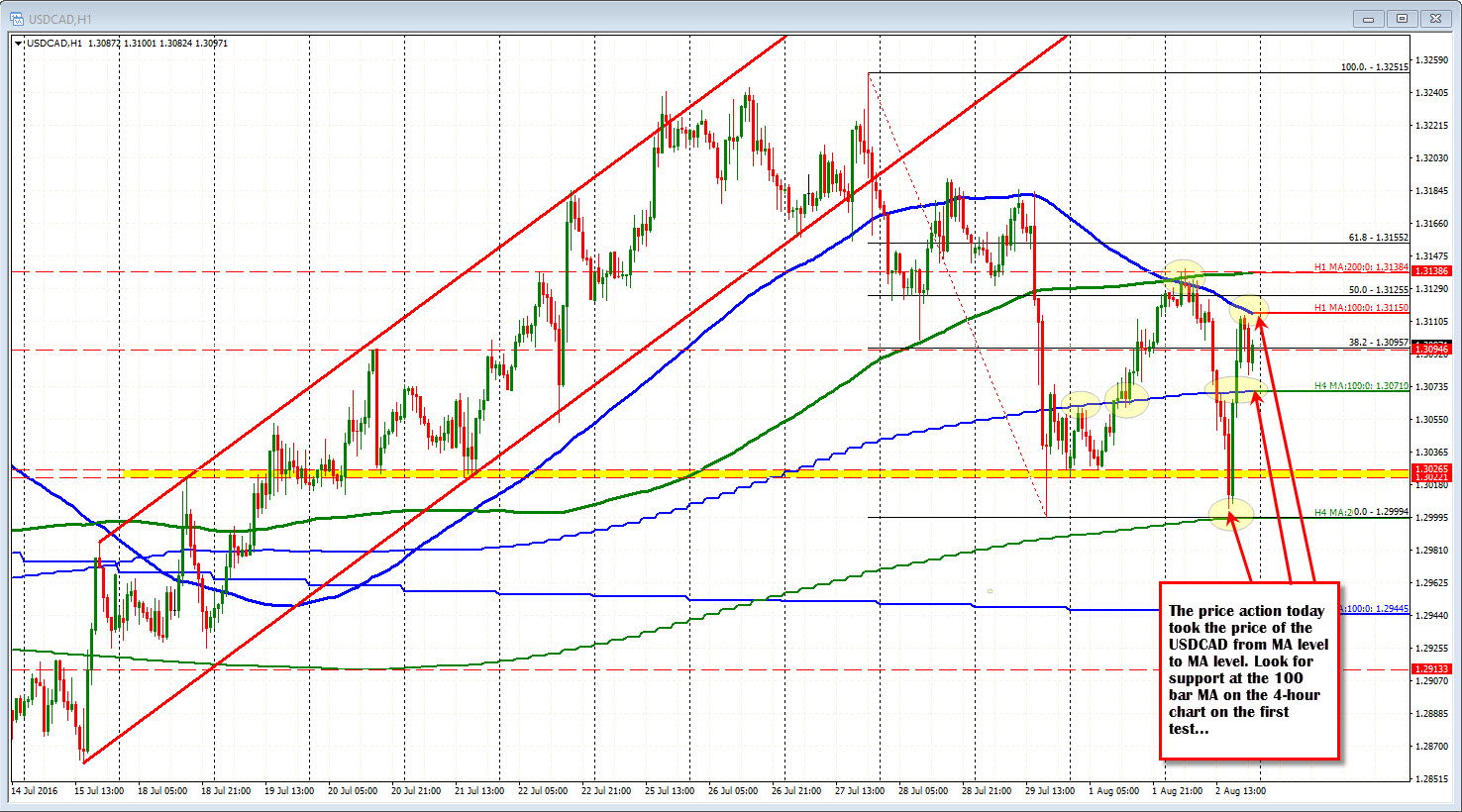

USDCAD

The USDCAD was whipped around by oil prices and technical levels. The pair held support against the 1.3000 level when oil was at the day's peak. This also corresponded with the 200 bar MA on the 4 hour chart. The subsequent rally, took the price up toward the 100 hour MA (currently at 1.3115) and the close from yesterday at the 1.3119 level (the corrective high stalled at 1.3114 just short of those targeted levels). IN the new trading day there should be support at the 100 bar MA on the 4-hour chart at the 1.3071 level.