The pair looks set for a fourth straight day of gains

.png)

From a technical standpoint, the pair hit a double bottom in August trading - bouncing off the 50.0% retracement level at 1.1261. And if you want to go by that, it was a good reason to catch a bounce.

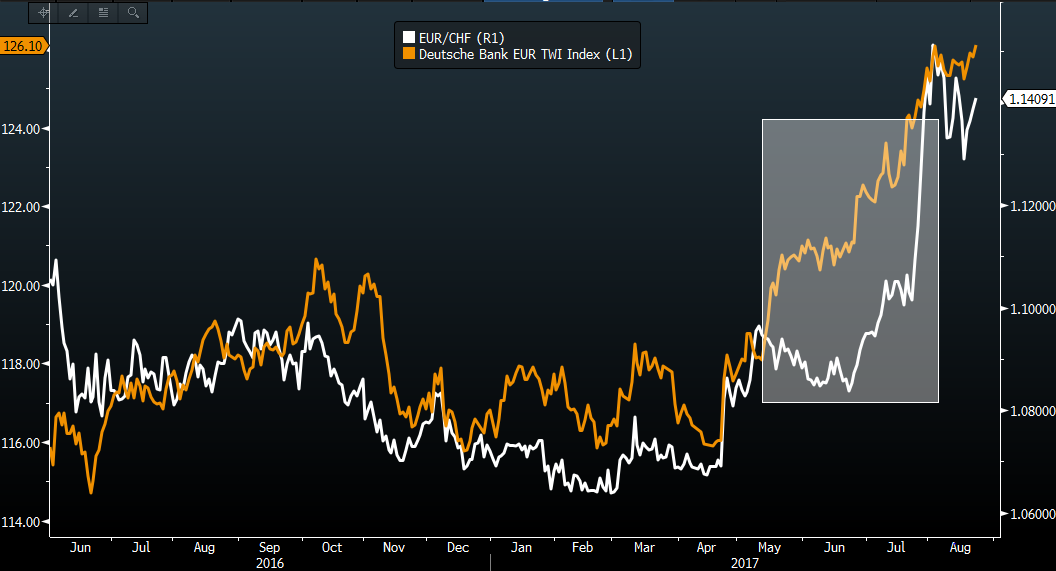

When looking at the pair over the last few months, I've been comparing it to the euro TWI (trade weighted index). Apart from the last two weeks, the swissie hasn't really been the haven currency/asset of choice to most investors - and the pair has tend to move in line with the euro's strength.

If you remember in late July, there was a surge in EURCHF. There were a lot of reasons in the market as to why the pair surged, but one simple correlation/explanation could just be EUR strength. And there was a big disconnect at that time as you can see below (I'm using Deutsche's EUR TWI as a proxy):

That meant the pair had some catching up to do. The recent risk aversion in the market caused the pair to stumble a little, but on a trade-weighted basis the EUR remains resilient. That provided the pair with another good opportunity to play some catch up again - and post further gains to the upside.

EURCHF is currently trading at 1.1417.