Major stock indices end higher

The European equity markets are closed and the provisional closing levels are pointing to gains on the back of better US China trade relations.

The provisional closes are showing:

- German DAX, +1.9%

- France's CAC, +1.1%

- UK's FTSE, +1.4%

- Italy's FTSE MIB, +2.26%

- Portugal's PSI 20, +1.52%

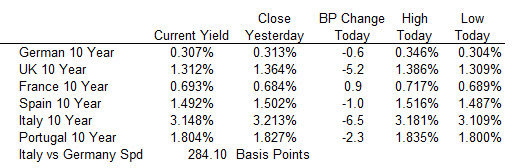

In the 10 year benchmark debt sector, yields are mostly higher.

A snapshot of other markets, as London/European traders move closer to the exit for the day:

- spot gold is up $11.45 or 0.94% at $1233.96

- WTI crude oil futures are up $1.27 or 2.51% at $52.21. That is off the highs at $53.85. The price is dipping back below the 200 hour moving average currently at $52.26. The technical waters turn muddy.

- Bitcoin on Coinbase is trading down $339.25 at $3808.07. THe low price just extended to $3741.95. The low from November 25 reach the thousand $456

US stocks are giving up their gains but still remain up on the day:

- S&P index is up 14 points or 0.51% at 2774.23. The high reached 2800.18

- Nasdaq index is up 73.35 points or 1.0% at 7403.68. The high reach 7486.51.

- the Dow industrial average is up 140 points at 25684

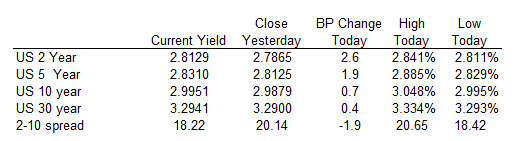

In the US debt market, the yield curve continues to flatten. The 2-10 spread flattens to 18 basis points which is the flattest and over a decade.

In the forex market, the NZD is now the strongest while the GBP remains the weakest.