EURUSD through the 100 dma and 1.1200

While eyes are on the pound the euro isn't having a good day. We've crunched the 100 dma at 1.1213, and then the big figure, which is already resisting as I type.

EURUSD 15m chart

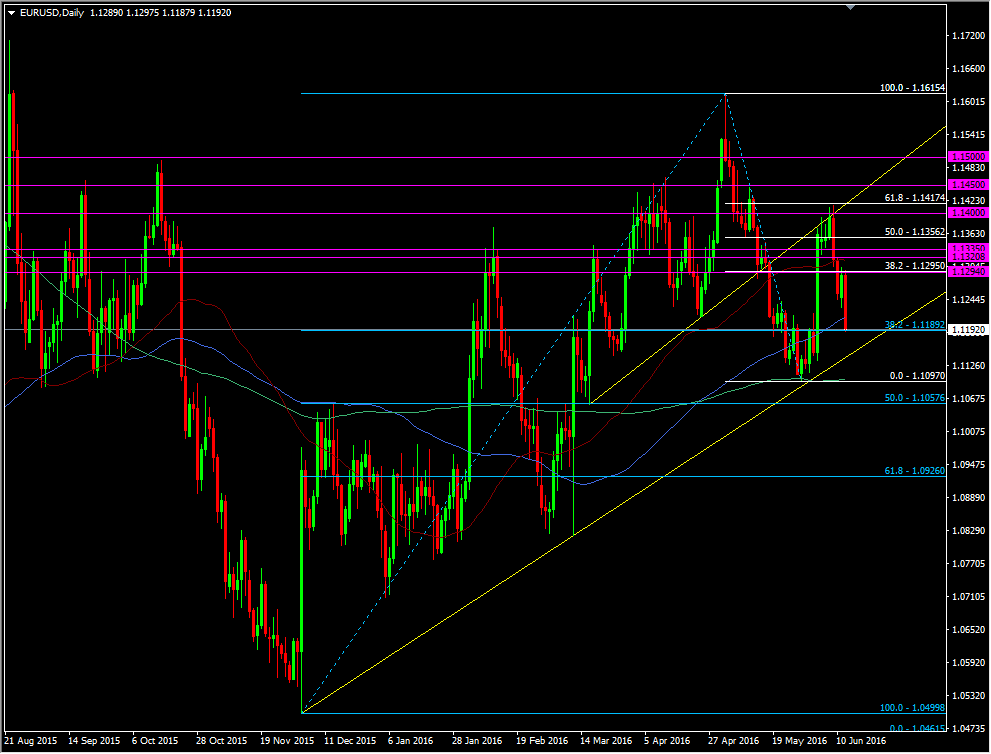

The 100 dma will likely hold further resistance, followed by the afternoon high at 1.1240.

We've got a decent amount of support down at the May low around 1.1100 via the 200 dma and 55 wma.

EURUSD daily chart

Unless there's some big news to crunch it, tech traders should be eyeing this level for longs or to think about taking some profit on shorts. There's fib support just under there at 1.1058 but a break there could bring a steeper fall towards the Jan lows.

If we get to this support before the Fed then there's a low risk trade on catching an unchanged decision from the FOMC. Although expectations for a hike are low, the market will probably still show some disappointment as the last USD hangers-on give up. That will be to the euro's benefit. I'm going to look at a long from just ahead of 1.1100.