Pop goes the weasel...

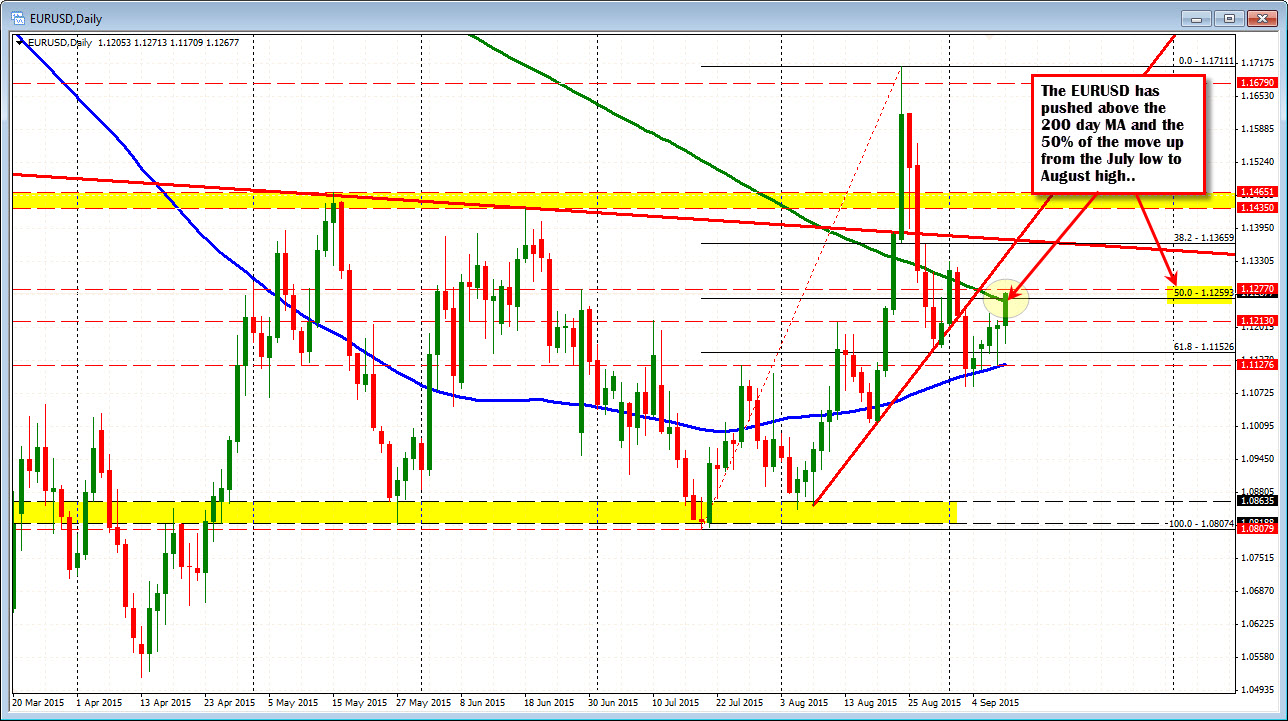

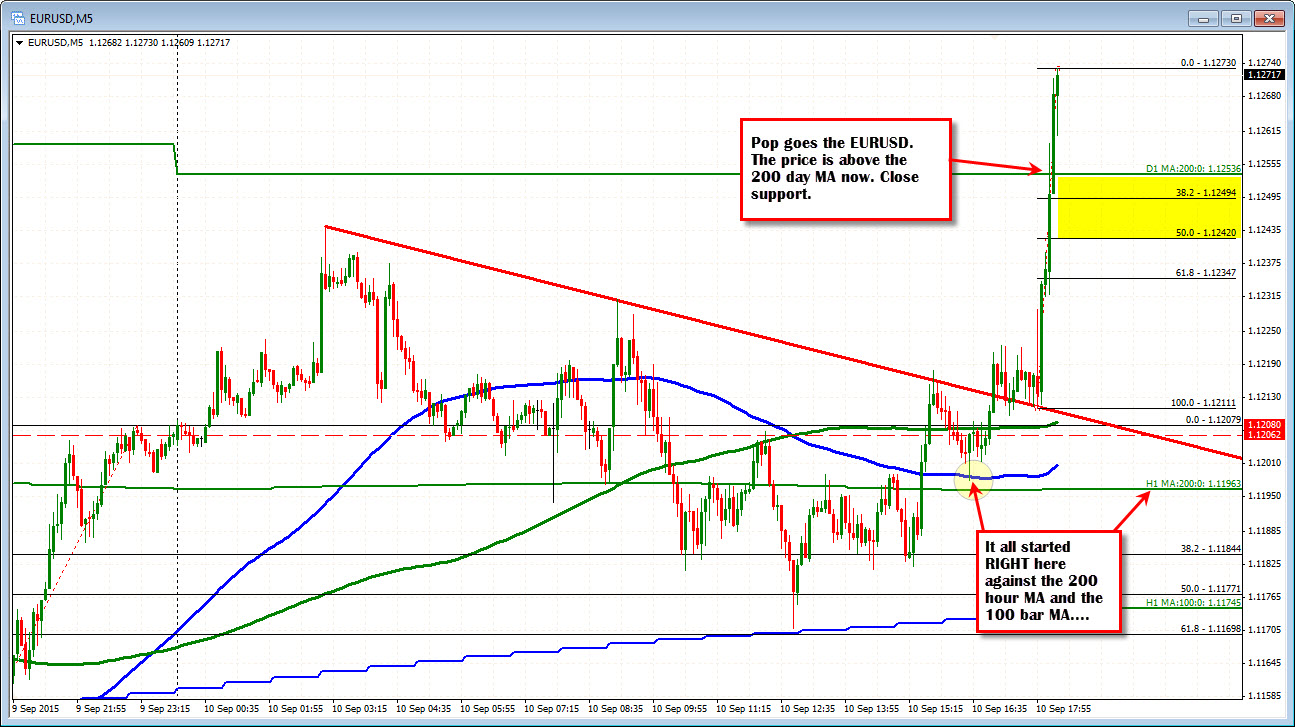

The EURUSD goes pop and scoots right up to the 200 day MA at the 1.1253 area. The 50% of the move up from the July 2015 low to the August high is also at the area (at 1.1259) and the combination makes this a key area. There should be resistance sellers on the test but be careful (in fact breaking above)

The range for the day is now up to 95. The average is 136 for the last 22 days. The range for the week was indeed extended as well. Seeing more buying up to 1.1270 now.

Targets include 1.1295, then 1.1319-31. The 38.2% of the move down from the August 24 high comes in at 1.13252 level (see hourly chart below).

Earlier today, I spoke of the need to extend. The weeks range was the lowest for the year (at 124 pips). It just is not right - especially given the 1st week of the post summer market. The technical levels started to hold. The technical levels started to give way, and I guess, some big boy(s) came in and made it happen..... Now traders will be looking for what was broken to hold.