Trend line broken but highs from Dec 4 at 1.0950 -55 area eyed

Do you think the ECB wants 1.1000?

Probably not, but we know from last week the price can go higher. Short positions remain high in the market and that increases fear as the price moves higher (or does not go lower). Technicals can also play a part as they help to define and limit risk for traders.

This week the price has scraped higher. Today has been more direct so far (at least compared to the NY session yesterday). The pair is up testing the next target resistance against a topside channel trend line (at 1.0945)and swing highs from Friday's trade (at 1.0950 and 1.0955). If traders are thinking broadly that 1.1000 is not where the ECB and Mr. Draghi want the currency, this is a technical level to lean against with stops above.

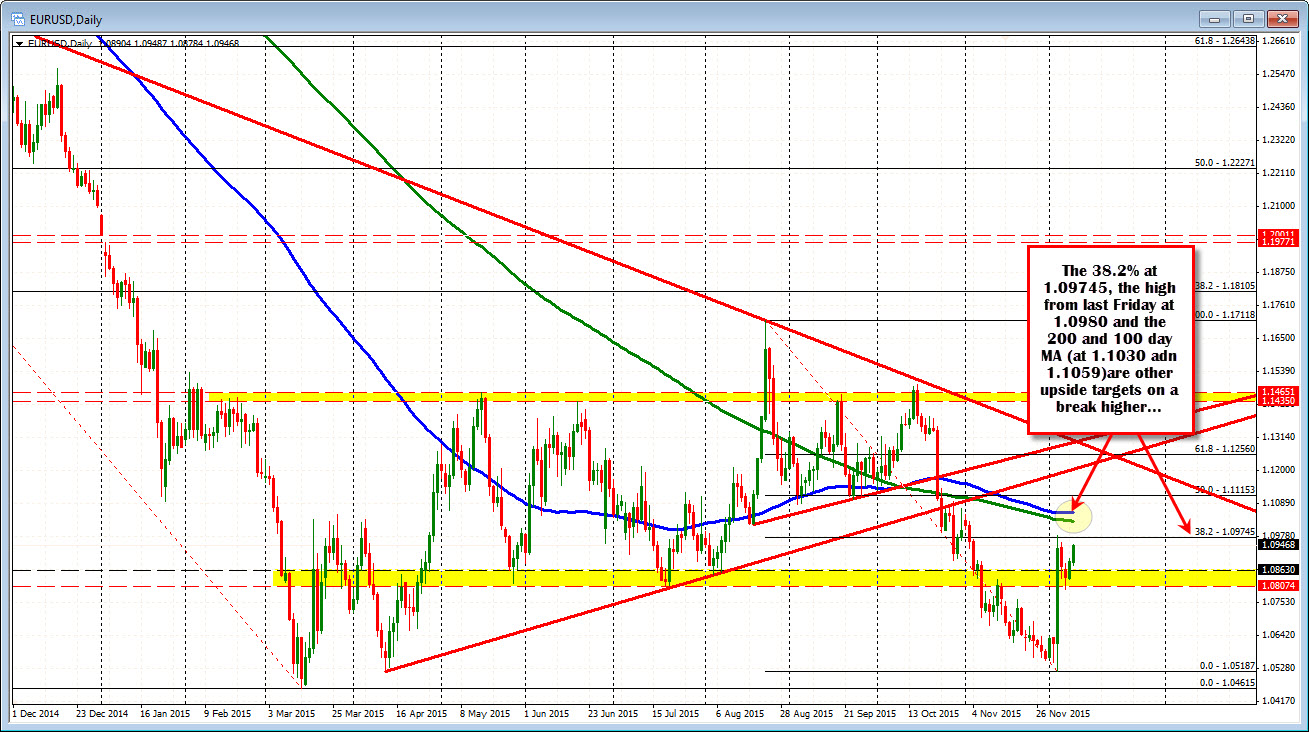

Looking at the daily chart, if the price is able to break higher the high from ECB day at 1.0980 will be the next stop. A move above that level and the 200 and 100 day MAs are at the 1.1030 and 1.1059 respectively (blue and green lines in the chart below).

Taking a quick peek before posting, the highs are holding the line in the first look. A move back below the trend line on the hourly will be eyed. Have to stay below that line.