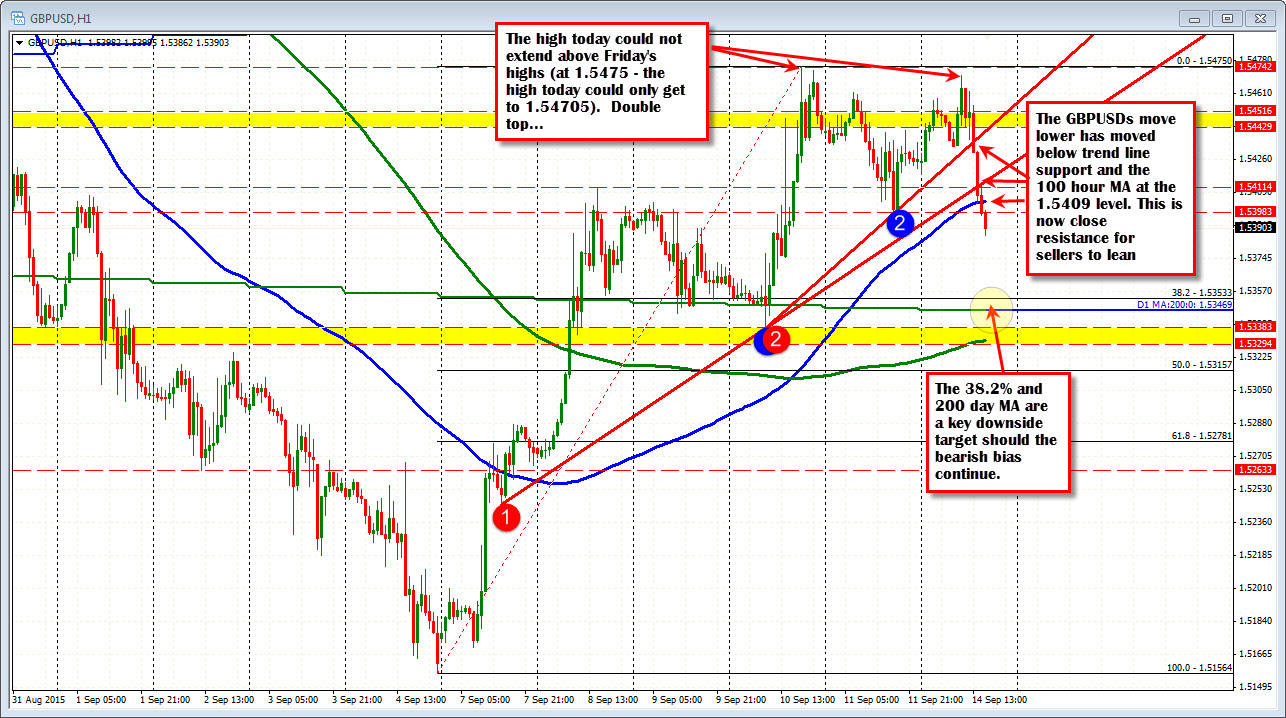

Double top stalls the rally

The GBPUSD - like the EURUSD - moved higher to start the week but has reversed course after failing to extend above last week's high at 1.5475. The high price stalled at 1.54705 (close enough for a double top). The move lower has done some technical damage to the downside that has helped neutralize the shorter term bias at least and put traders on a corrective path.

More specifically, the price has slid below upward sloping trend lines, and also the 100 hour moving average (blue line chart above). the 100 hour moving average currently comes in at 1.5404 and this is close resistance in trading now. Stay below and the corrective shorts have the potential for further downside momentum.

How far can the pair correct? Looking at the chart above, the next major targets come in against the 38.2% retracement of the move up from the September for low. That level comes in at 1.53533. The 200 day moving average is also near that level at the 1.53469 price today. This area should find support buyers IF the momentum and the bias can remain bearish (watch 1.5409).