Reverses higher after earlier dip

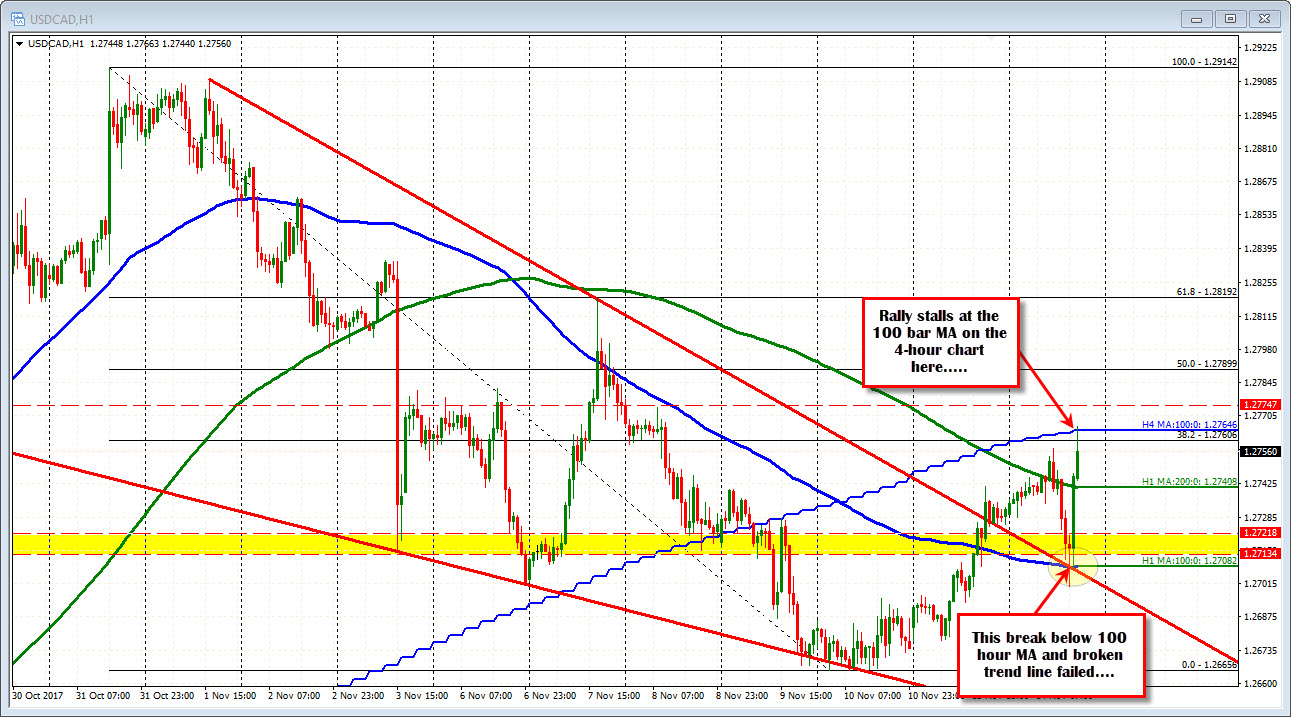

The USDCAD fell below the 100 hour MA shortly after the US PPI report. The price also moved back below a broken trend line (see chart below). That break failed and the next hourly bar stalled at that MA line. Buyers showed up and sellers turned back to buyers.

The move higher has now taken the price back above the 200 hour MA at 1.27408 and the prior high for the day at 1.27567. The 200 hour MA will now be eyed as a risk level for longs. Stay above is more bullish.

The high for the day, so far stalled right around the 100 bar MA on the 4-hour chart at 1.27646 (the high just reached 1.2766). That MA may slow the rally in this up and down and up day. The range for the day is 56 pips so far. The 22-day average is 66 pips. So on a break, there is room to roam higher. The 50% retracement comes in at 1.27899 would be a target on a break.

For now though, look for sellers to continue the lean against the 1.27647 level on a test, with stops on a break.

PS helping the CAD weaken may be WTI crude oil futures which are now down -$1.25 or 2.17% to $55.56.