It IS ok....

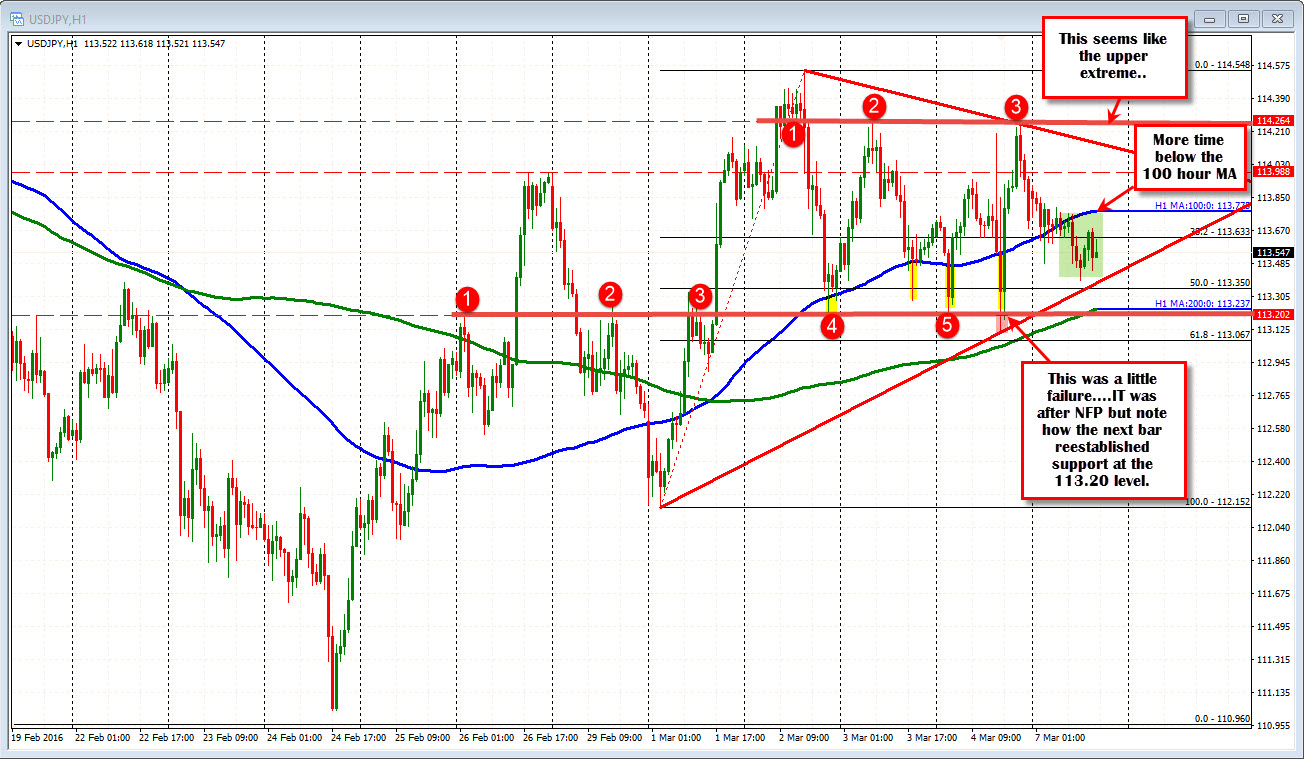

The USDJPY is non-trending and that is ok. The pair over the last 4 1/2 days has traded above and below the 100 hour MA (blue line in the chart below). The prior three days has spent limited time below the line (see yellow shade area). Today, more time has been spent below the MA line - which is a little more bearish (see green shaded area). If the market is to continue to non trend, expect more of the same above the MA, below the MA. It is what happens.

What is more important in a non trending market, is to define extreme levels. The 113.20 area is a lower extreme. The 114.26 is an upper extreme. Just above the lower extreme is an upward trendline. Below the upper extreme is a downward sloping trend line. They are steps that may hold support or resistance. You never really know in a non-trending market.

When the pair non-trends, there could still be failed breaks of those extremes, If they occur, look for a reversal and move the other way.

Traders mindset should be to:

1. Be patient

2. Trade extremes

3. Expect MAs (like the 100 hour MA) to flatten and for the market to trade above and below.

4. Look for failures of breaks. IT might be the trend lines. It might even be an extreme like on Friday. The failure typically shift the bias around.

5. Be patient (worth repeating).

The market price non-trends because "the market biggest players" have not decided what it wants to do next. Eventually, they will decide. In which case the price action will show the way. It is hard to hide a change in sentiment...