"Halting tightening cycle would imperil economy"

The USDJPY is stretching to new session highs after FOMC's Dudley more hawkish comments. US treasury yields have moved into the black and are up about 2 bps after being down about 1 bp before his comments.

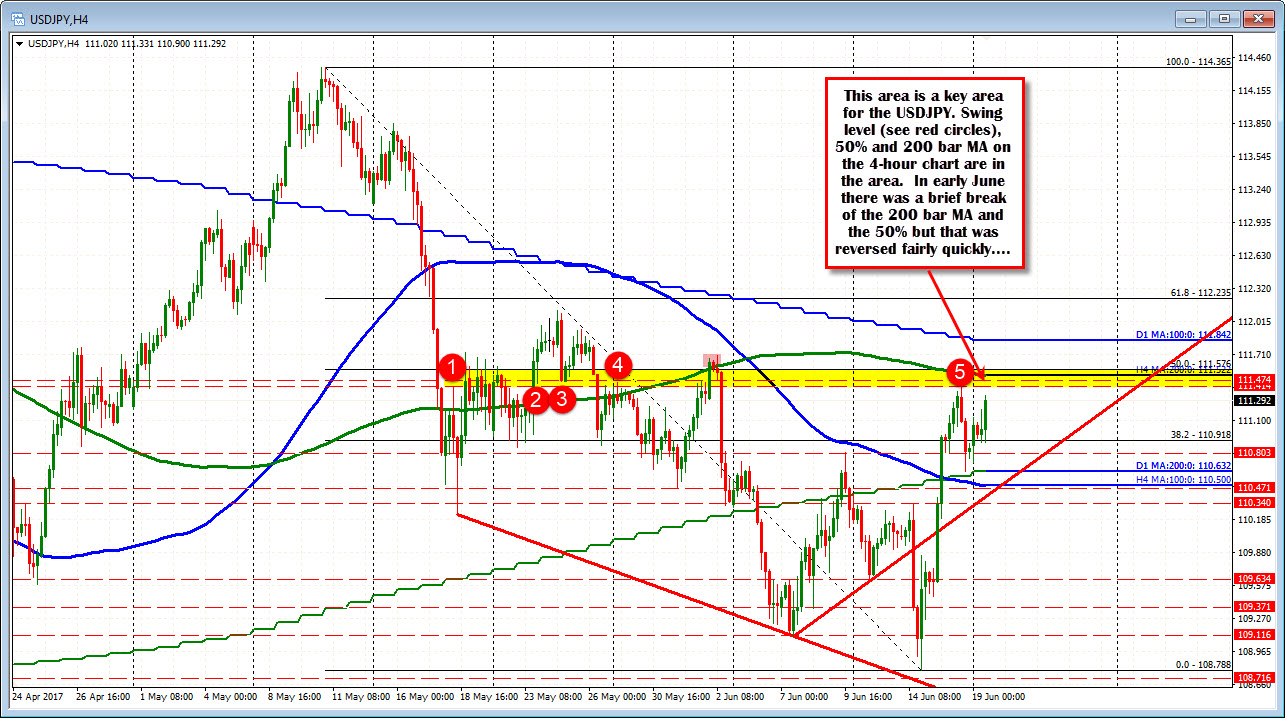

Technically, the pair targets the high from last week at 111.414. The 200 bar MA on the 4-hour chart comes in at 111.522. The 50% of the move down from the May high cuts across at 111.576. That cluster of resistance should provide some cause for pause on a test today, but the bulls are in control.

In the Asian session, the pair reaches a low of 110.71. That got within 8 pips of the pairs 200 day MA. On Friday, the MA was also sniffed and the price bottomed and moved back higher. Staying above the 200 day MA, keeps the buyers more in control. Looking at the 5-minute chart below, it shows the support at the 200 day MA overlay. Bullish. The price also bounced off a trend line (red circle 3). Also bullish.