A long-term view on the AUD from GS, applying Elliot Wave.

Can't say I am a user of EW at all but for those who are, comments welcome!

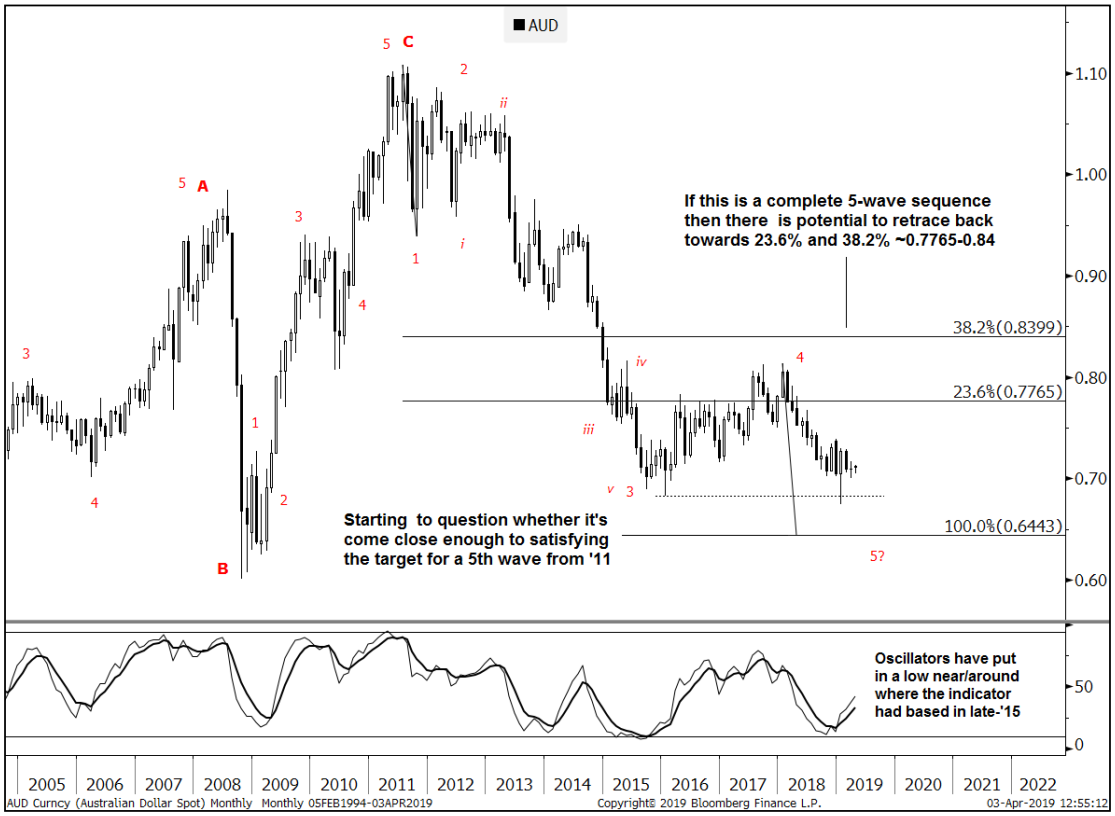

AUDUSD started a 5-wave decline at the '11 high

- A typical 5th wave will test the bottom of its preceding 3rd; in this case the low from Jan. '16 at 0.6827. It will often exceed that level continuing on towards a minimum target derived from the length of wave 1; in this case 0.6443.

- While it hasn't quite made it to 0.6443, it has however posted a fairly strong bullish hammer pattern on a test of the 0.6827 low from Jan. '16. Moreover, monthly oscillators are back at the base of their range and starting to curl over; near similar levels to where they based in '15/'09. This should therefore be an important place to watch for a reversal in trend. The question to ask now is whether it's gone far enough already.

- Once 5-waves are in place, AUDUSD will likely enter an extended period of positive price action; i.e. overlapping/higher for up to a year. That might retrace at least 23.6% back to 0.7765 and up to 38.2% at 0.84.

View:

- Watch for signs of a base/reversal against 0.6827. Could extend as far as 0.6443. Eventually expecting sideways/higher price action for a lengthy period of time

--

ps. Note is from the weekend, and the chart appears older than that, but given the multi-year time frame that is not critical.