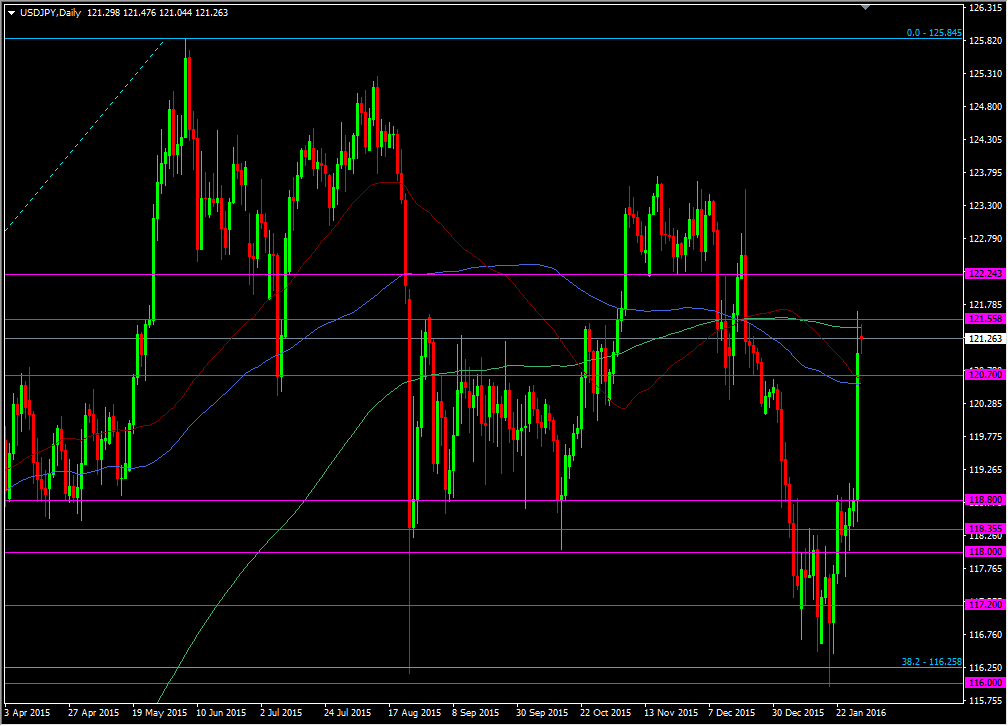

121.55/60 marking the top of the BOJ rally

Looks like I missed a good day Friday. The BOJ surprised with their move and sent USDJPY into orbit.

After the initial move resistance has come in around an old level of 121.55/60. Further to that the 200 dma has been keeping things in check at 121.44.

USDJPY daily chart

It was pretty much one way traffic up to the highs and we're still watching the support developing. That picture is still a bit unclear. At the moment 121.00 is the main support and that extends down to around 120.90.

USDJPY 15m chart

Additionally, short term traders are being helped out by the 100 ma on the 15m chart and the 55 ma on the 30m chart.

Below 120.90 we have a very old level at 120.70, and this is one to keep an eye on. It didn't do much in the initial volatile move but could well have a say on another test. If it breaks then we could well see a quick move down to 120.00.

What the intraday moves are showing is that there's no real desire to push the price anywhere right now, and that means the BOJ move is all but done for now.

The big question is where do we go from here?

The standout point is that we are still very much well within the recent ranges. We tried the downside at 116.00 and now we're pushing some of the upside levels. From where we sit now, that means there's a hell of a lot of work needed to run up to the 2015 highs. The BOJ could turn very dovish, which will keep the pressure on the upside but I can't see that happening right now, and they will want to give this policy move plenty of time to play out. On the other side, the market is struggling to build a case for a hawkish Fed for March so again, I see a big upside push as hard work.

There's some big data out today from the US. PCE prices will give us another gauge of inflation. The core sits at 1.4% and another move towards 2% would be mildly bullish for the Fed, same as the CPI core sitting at 2.1%. The personal spending and income data will be another insight into how US household finances are fairing.

After that we get the big ISM manufacturing PMI for Jan. We'll find out if the US can claw its way back towards expansion.

Plenty of data to help push the dollar around. If we get good data that doesn't push the price through the upside levels, then that's going to start sounding alarm bells for recent longs, and could spell trouble for this move. Right now, let the price be the paintbrush for this particular picture and see how it develops.