200 day MA and 38.2% retracement

Keeping things simple, the 10 year bond yield is up testing some key technical resistance. The 200 day MA is at 2.1914% and the 38.2% is at 2.1763%. The current yield is at 2.1781%.

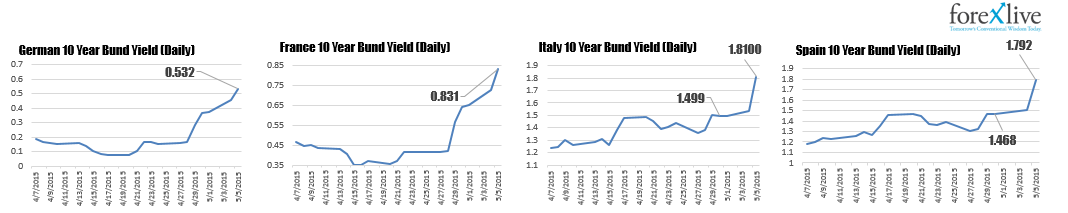

We know from the forex market, that traders like to lean against risk defining levels to define and limit risk. I would expect this area to be a key resistance level for the bonds as well - with stops above if the unwind continues. As Adam points out in his prior post, the surge is not a US thing. Bond yields in Europe are also on the rise. The impact for the currency? A lower dollar so far. Each of the major currency pairs are trading at extremes with the dollar being the whipping dog.