This via SG on the DXY

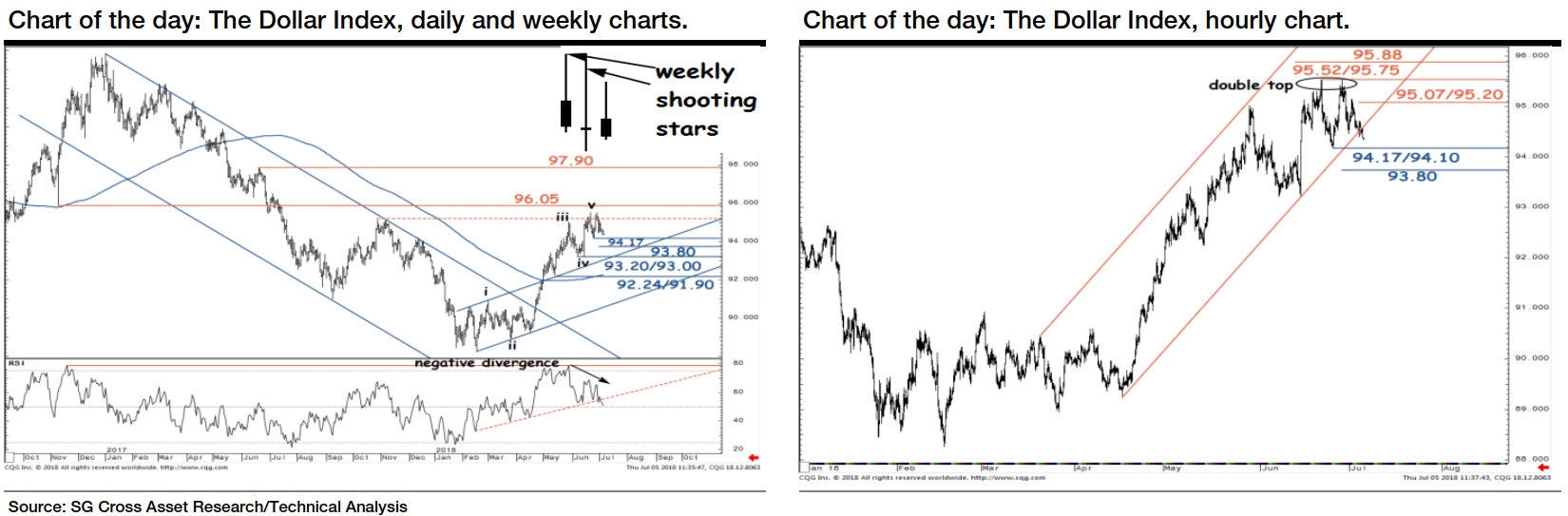

After failure to give a definite break beyond last October peak, the Dollar Index has started staging a pullback.

- It has formed two consecutive weekly shooting stars near 95.52/95.75 which suggests upside momentum is lacking. The index has formed a double top at those levels and is now breaching below an up sloping hourly channel.

- Expect a retest of the neckline at 94.17/94.10, also the 61.8% retracement from late June lows. If this gives way, the Dollar Index will unfold a deeper correction towards 93.80, the 23.6% retracement of whole recovery since February with next support at the previous channel near 93.20/93.00, also the trough of June. 95.07/95.20 is an immediate hurdle. 200 day MA at 92.24/91.90 should be a mid-term support.