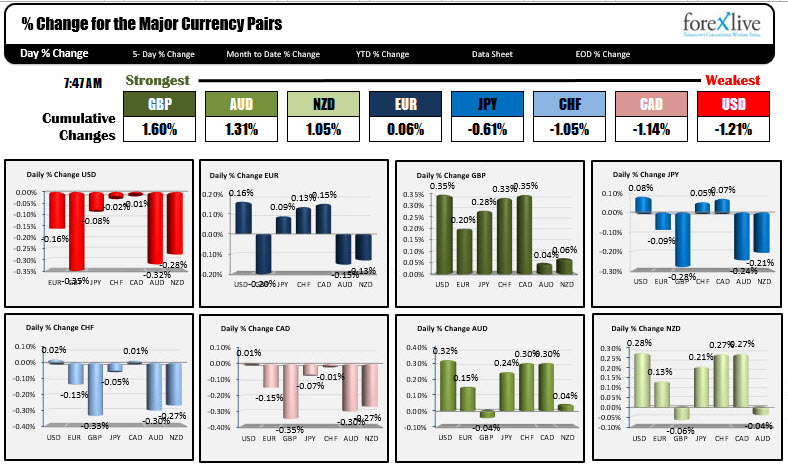

The GBP is the strongest. The USD is the weakest.

As North American traders enter for the day, the GBP is the strongest while the USD is the weakest. Take note, however, the spread between each is very narrow. All the currencies are more bunched together.

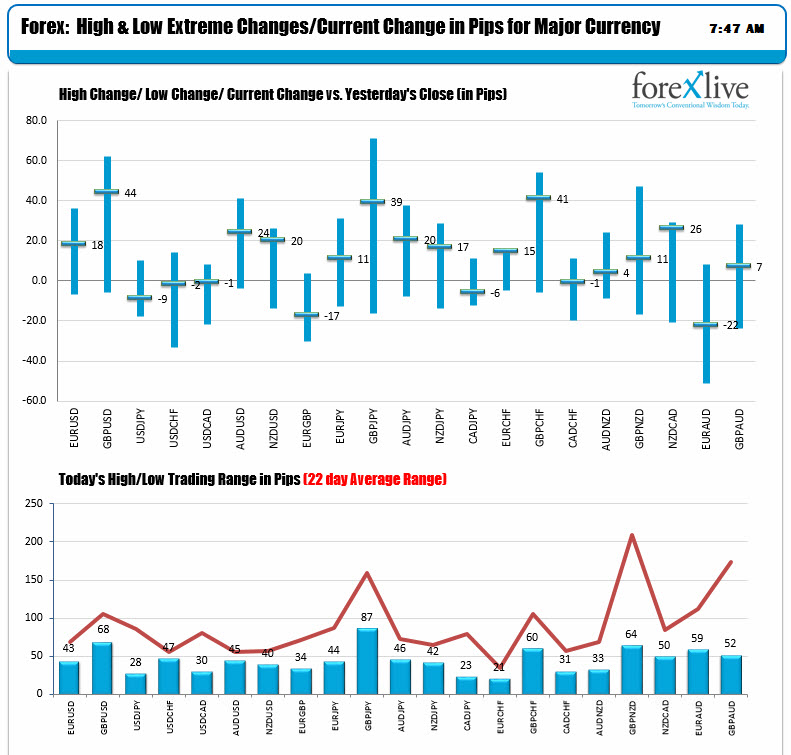

Nevertheless, the GBPUSD is the biggest changer on the day after a very quiet day yesterday (less than 40 pip range). Today, the pair moved above the 100 hour MA (blue line in the chart below at 1.26833 now) and the 200 hour MA (green line at 1.2718 - risk now for longs looking for more).

As you might expect, the ranges for the major currency pairs are all below their 22 day averages (about a month). That too highlights the lack of volatility in the market. It is Friday, in the dead of the summer. That can be expected.

Key data out of NA at 8:30 AM ET/1230 GMT, is the Canada CPI (MoM +0.2% est , YoY 1.5% est).

At 9:45 PM ET/1345 GMT, the Markit US manufacturing PMI (P) is expected to rise to 53.0 from 52.7. Services is expected to dip slightly to 53.5 vs 53.6 last.

At 10 AM/1400 GMT, the US new home sales for May are expected to come in at 590k vs 569K. Earlier this week existing home sales came in better than expectations.

Feds Bullard speaks at 11:15 AM ET/1515 GMT.

Bakers hughes rig count will come out at 2 PM/1700 GMT and CFTC Commitment of traders will be released around 3:30 PM ET/1830 GMT

In other markets NOW:

- Spot gold is up $6.29 or 0.50% to 1256

- WTI Crude is little changed at $45.28

- US yields are up a smidge with 2 year up 0.4 bp, 10 year up 0.7 bp and 30 year up 0.0 bp

- US stock futures are unchanged to a little lower with S&P futures +0.50, Nasdaq down -4.50 points and the Dow futures down -31 points.