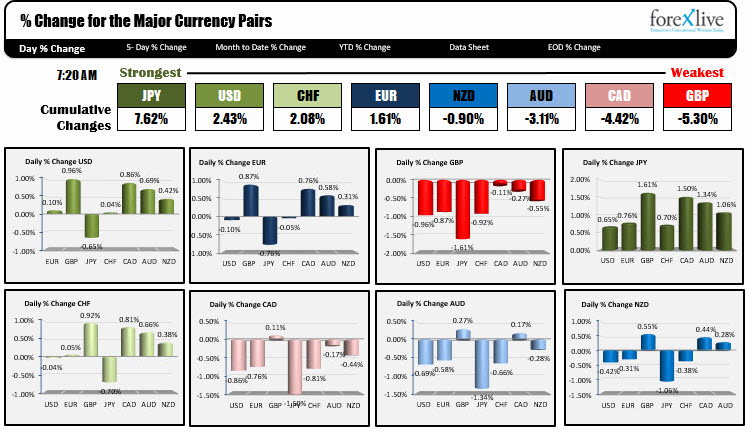

March 15, 2016. The JPY is the strongest. The GBP is the weakest.

The JPY pairs are all looking pretty sick giving rise to the JPY in trading today. The BOJ removed the statement they "would cuts rates further into negative territory". The Nikkei fell and global stocks are lower. The GBP has some negative Brexit thoughts, the budget, increasing chance of easing, and negative technicals are hurting the GBP.

The US dollar is in a distant second for strongest currency of the day. The FOMC is coming up tomorrow at 2 PM.

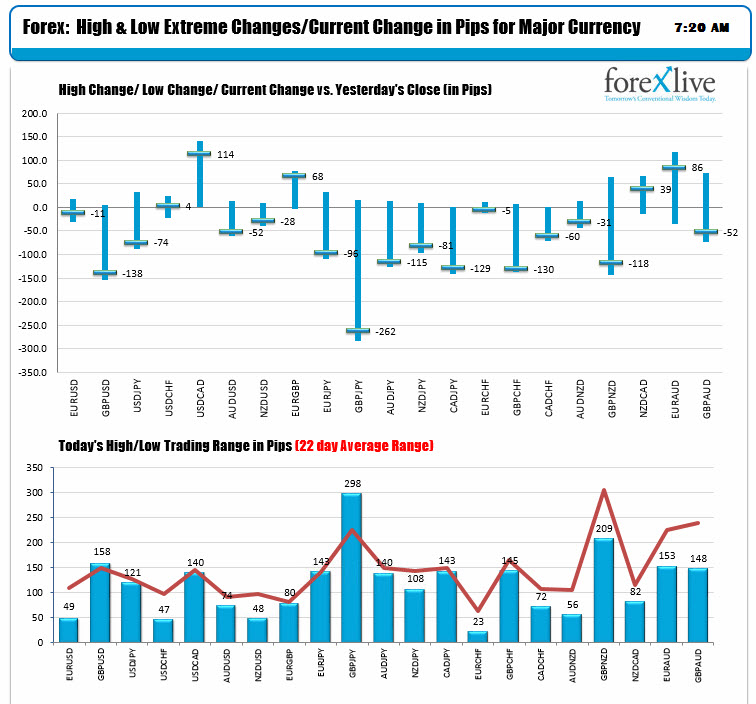

The ranges and changes show the movers and shakers (GBP, JPY, CAD) and the laggers (the EUR, CHF are just watching with high low ranges < 50 pips. Retail sales for the US is a big release this morning (see Adams preview here). Ex auto and gas and control group expected to both rise by +0.2% (last month they were +0.4% and +0.6%). The headline number is expected to decline by -0.2% (last month was +0.2%).

Other releases:

- US PPI estimate -0.2%. Core PPI +0.1%

- Empire State manufacturing index, estimate -10.5 vs. -16.64 last

- Canada existing home sales. Last +.5

- US NAHB housing market index. Estimate, 59. Last 58