November is a solid month for the Dollar Index

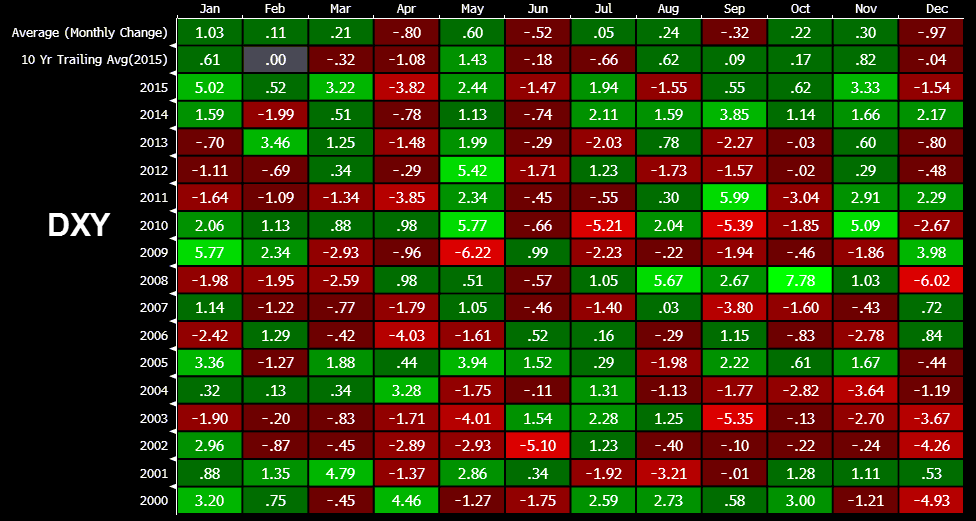

The US dollar has risen in November for six consecutive years. In 2015, it gained 3.33% as the Fed edged toward a rate hike. The same dynamic is in play this year.

In the bigger picture, the DXY has gained an average of 0.30% over the past decade in November.

That's only the third-best month so normally it might not merit a mention but what's different this year is the election. I can make a case for USD longs no matter who wins.

If Clinton cruses to victory, the US dollar is likely to rally on hopes for government spending to fuel growth. If she can win convincingly, it could cool off the political climate and loosen Congress' grip on the Federal wallet. That would be an especially strong factor if Democrats could win the House and Senate as well.

If Trump wins, the surprise factor alone will cause risk aversion and lead to dollar strength. Beyond that, he would also be likely to gain control of the Senate and House is Republicans swamp the polls. They may try to shore-up their popularity with fiscal spending.

The negative outcome for the dollar would be a narrow Clinton win. That would cause some USD-positive risk aversion but the risk of uncertainty and a long-term poisoned political environment would make JPY or EUR a better trade.