NAFTA hopes. Higher oil. Trying the downside again.

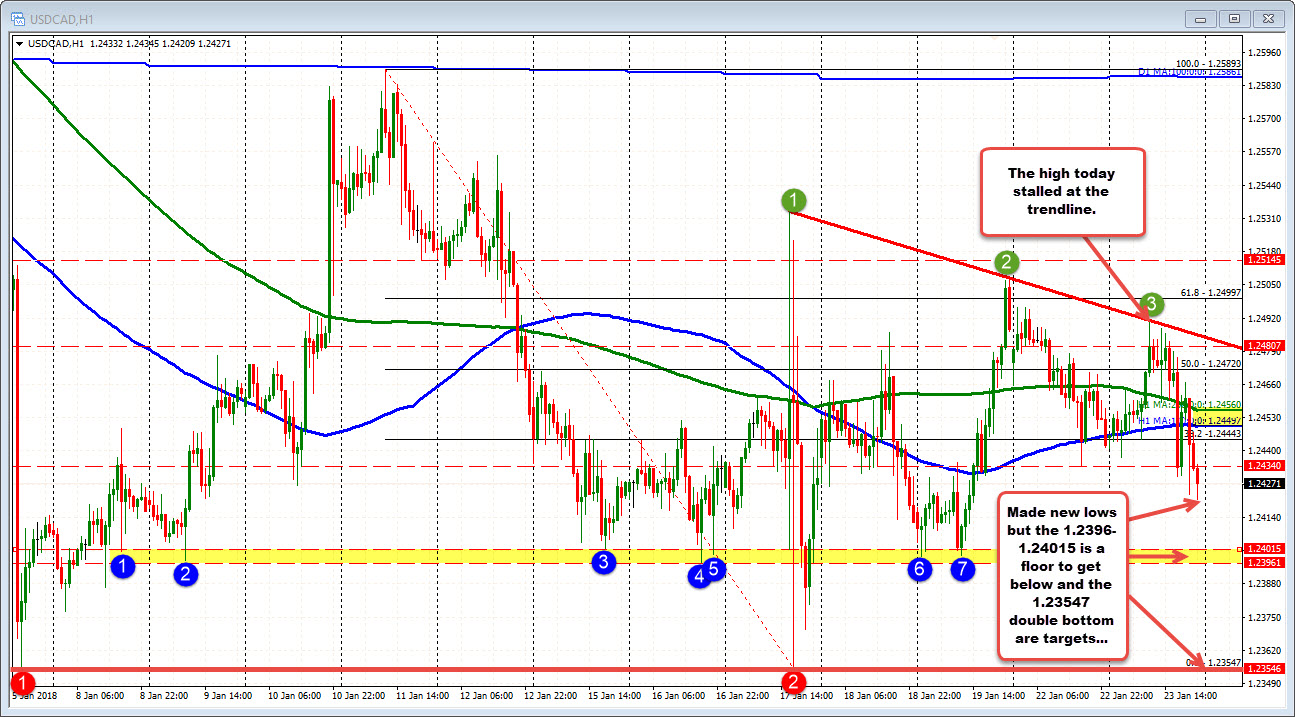

There is a lot of chop in the USDCAD chart, but the pair is trading at new session lows, and is trying to turn the tide to a more bearish bias.

Helping the cause includes:

- Oil is up $1.17 or 1.84%

- Hope that current round of NAFTA talks will yield positive results (don't collapse might be good news).

- Technically, the pair at the high today stalled at a topside trend line (bearish) and the price is moving away from the 200 and 100 hour MAs (green and blue lines in the chart above).

What would help the bears/sellers cause going forward?

The 1.2396 to 1.24017 will an area to target below. If broken, the 1.23547 becomes the next key support. That level was the swing low from Jan 5th (after the employment report) and the low after the rate hike on January 17th.

There is some selling. Is it running? No, but if the momentum can continue to and through the aforementioned levels, the selling should intensify. However, given the chop in the market, I would expect those levels to be tough levels to crack. Don't be surprised to see buyers on tests, with stops on a break.