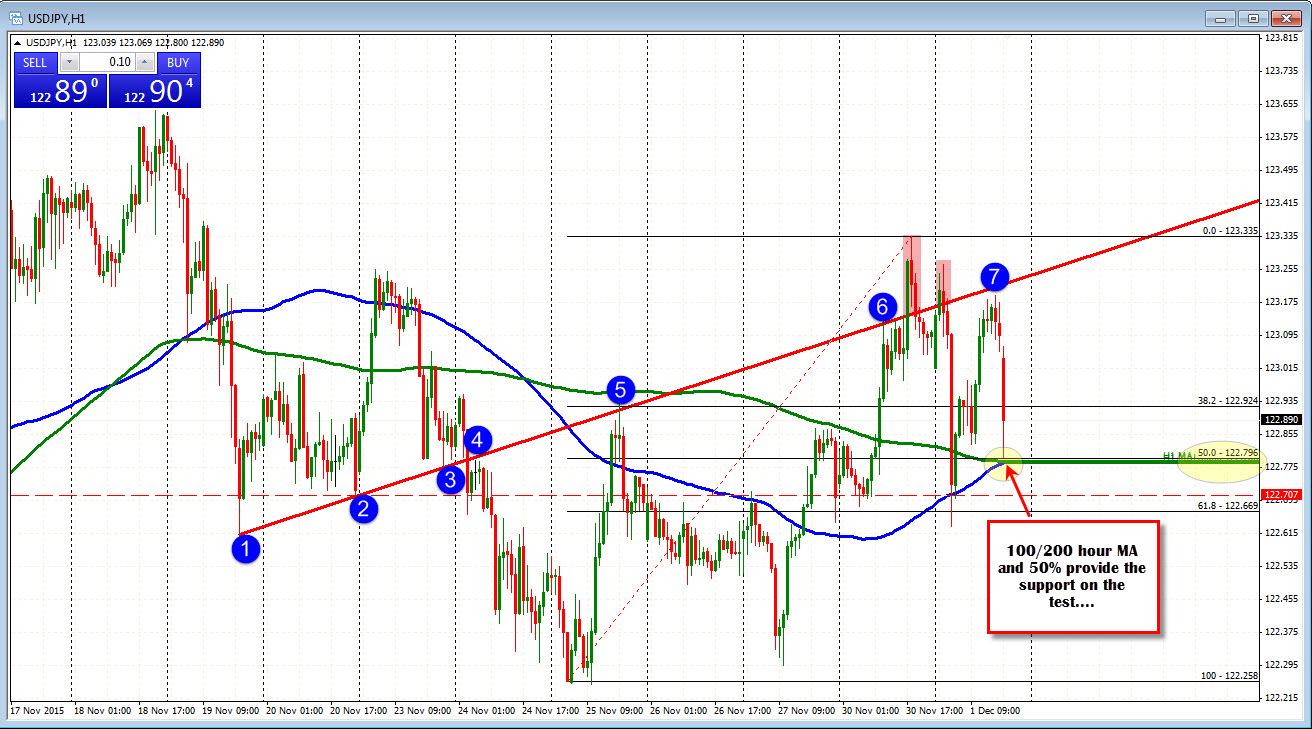

50%, 100 and 200 hour MA stall the fall

The USDJPY took a tumble on the back of the ISM mfg index going to < 50.0 but with the central bank alert on "Red Alert" traders stuck a toe in the water when the 50%, and 100 and 200 hour MAs were approached. Sellers from above take profit. Buyers looking for the dip buy. Both can use the level to define and limit risk.

The Fed tightening dollar bulls certainly would have liked to see the ISM not show contraction, but should it stop the Fed? There is a hurdle with "unenjoyment" ....err unemployment on Friday. Barring a negative number, the Fed will likely still "liftoff"(they are firmly painted in the corner), but you can be sure with manufacturing <50.0, the Fed jawboning will be to keep the dollar from rising too far too fast and also that the tightening cycle will be SLOWWWWWW.

Don't fall in love with your positions. Pick your spots. The 100 and 200 hour MA (and 50%) was one traders used today. The market action says that too me (PS look at the EURUSD come right back down.....).

PS. I like the Turd Polish from Ryan's post....