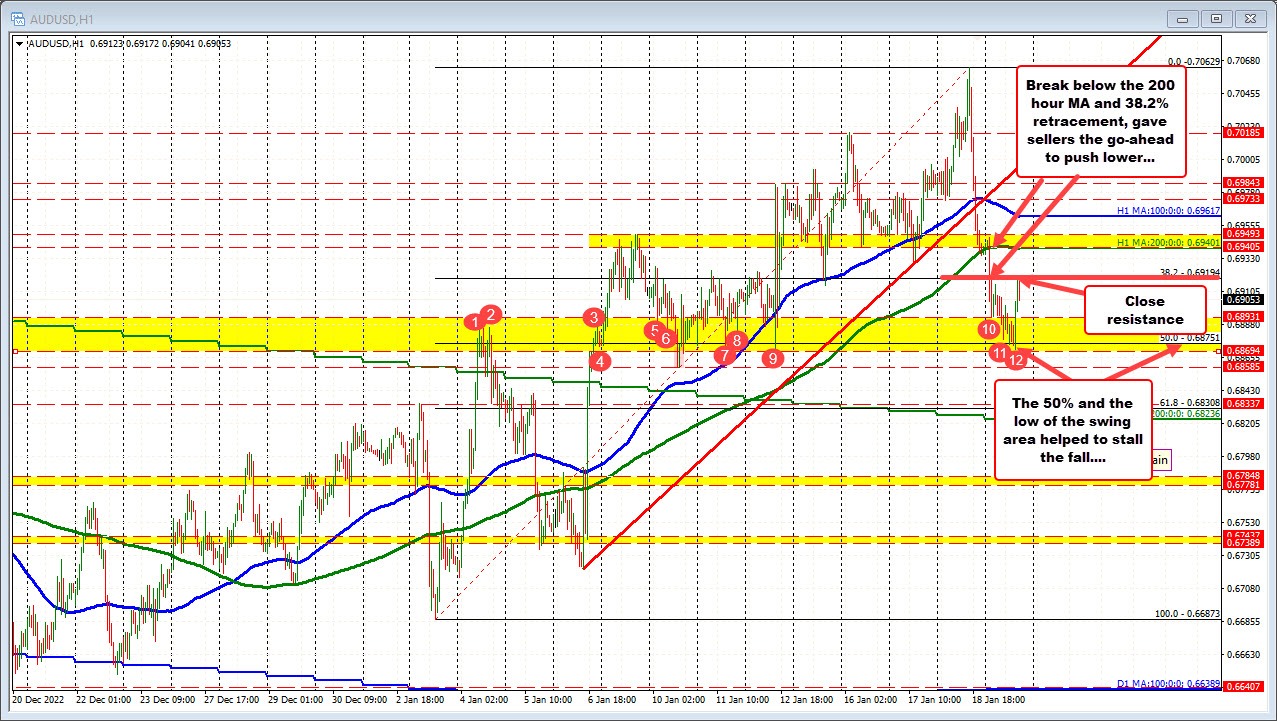

The AUDUSD moved to the highest level since August 15 yesterday reaching a high of 0.70629. That move took out the highs from Monday's trade at 0.70185. However after moving back below the high price for Monday, buyers turned to sellers and forced the market through the 100 hour moving average (blue line), and upward sloping trendline.

The subsequent move lower took additional steps including.

- Moving below the 200 hour moving average (green line in the chart above)

- Moving below the 38.2% retracement of 0.69194

- Moving into a swing area between 0.6869 and 0.6893

- Moving briefly below the 50% retracement at 0.6875

The low price ultimately bottomed near the low prices going back to January 12 and January 11 near 0.6869 and the afforementioned 50% retracement, and has bounced higher over the last three or so trading hours.

That bounce higher has returned back to the 38.2% retracement at 0.6919. The price is currently trading at 0.6898.

What next?

The step move lower seems to have found its equilibrium near the 0.6869 swing low and the 50% midpoint of the January trading range at 0.6875. However, the selling pressure and momentum to the downside is also finding willing sellers near the broken 38.2% retracement at 0.6919.

So there is a bit of a battle going on between the retracement levels. That battle will ultimately decided by a break outside the range. With the most recent flow of funds lower, the downside seems to the dominant for now but the 50% needs to be broken and stay broken.

The decline has been helped by risk off sentiment. The US stocks remain negative on the day. Technically, the NASDAQ index is back below the 100 day moving average at 11012.43 after closing above it on Monday and Tuesday. The S&P index as also cracked back below its 200 day moving average at 3971.92, but is approaching some support at 3879 to 3889 (the price is currently at 3897)., Below that is the 100 day moving average at 3865.24. Both levels will be important in the short term to determine if the upside of the downside is the preferred bias for the indices after the early 2023 bounce to the upside.