The GBPUSD has dipped back below the 50% midpoint of the range since 2021 high. That level comes in at 1.2300. The low reached 1.22652, but has bounced back toward the 1.2300 level.

The price just traded back to 1.22977. Watch the 1.23000 for short term bias clues today.

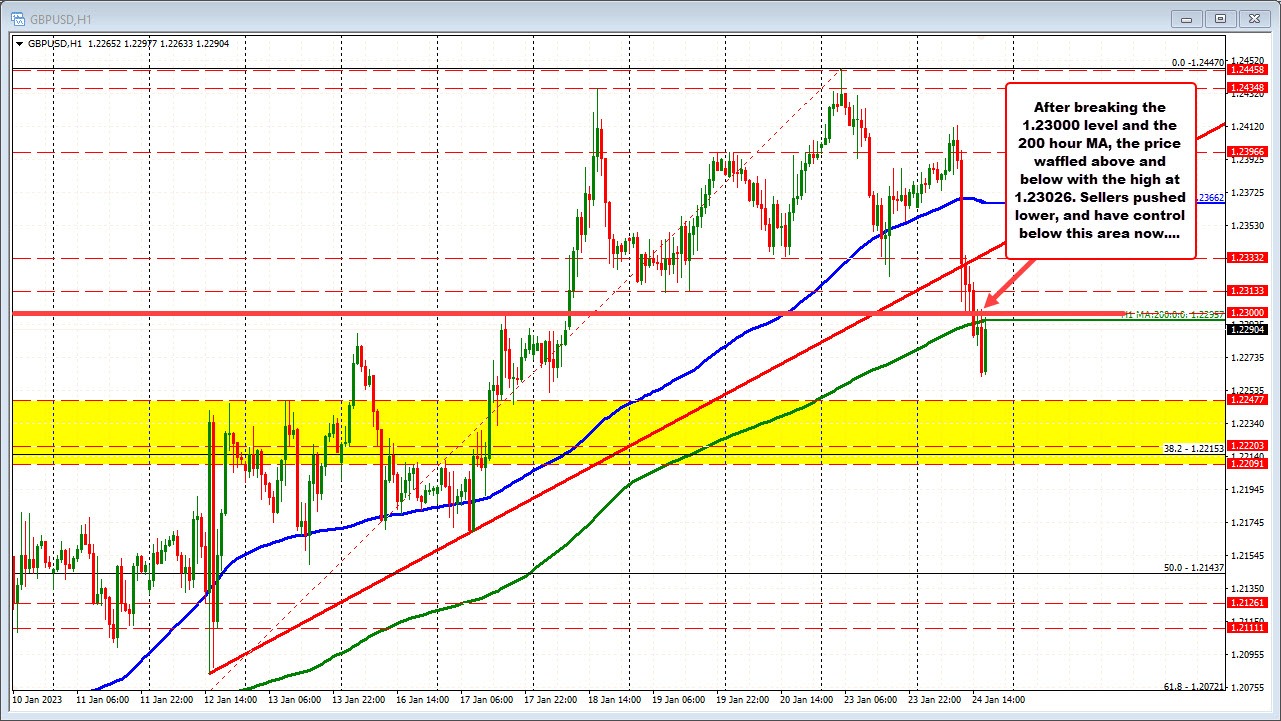

Taking a look at the hourly chart below, near the 1.2300 level is the 200 hour MA at 1.22957. That increases the areas importance. The price of the pair fell sharply today and traded above and below the 200 hour MA at the start of the NA session. However, the highs after the break reached only to 1.23026 - just 2.6 pips above the 1.2300 level. So there was some pause around support, but the bounce was also limited.

What now?

The 1.2300 area with the 50% and the 200 hour MA both near the level, increases that levels importance for both buyers and sellers. If the sellers can continue to keep a lid on the pair against that area, the sellers are still in control.

Conversely, if the price can start to trade more comfortably above 1.2300 -1.2303, the sellers should turn to buyers on the failed break.

The 1.2300 area is the risk and bias defining level in the short term now.