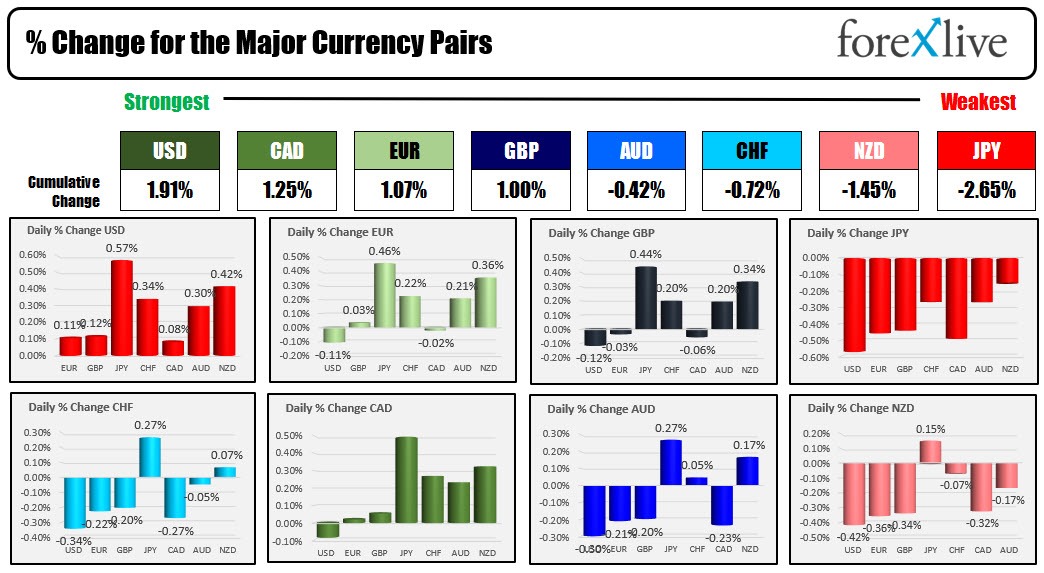

The USD is the strongest and the JPY is the weakest as traders (some traders) in the US return from the Thanksgiving holiday with a drinking and/or eating hangover. Oh the pain. Today the US stock market will close early at 1 PM ET. The bond market will go until 2 PM. England vs US starts at 7 PM GMT, or 2 PM in ET.

There are no economic releases on the US or Canada calendars today. In German today the GDP for the 3Q came in at 0.4% vs 0.3% estimated. The GfK consumer sentiment meanwhile improved - that's the good news - but to -40.2 from -41.9 last month. That is surfing the lowest levels. The German 2-10 year spread (-26 bp yesterday) is at the most inverted in decades, which is the same for the US 2-10 year spread (-77 bps).

China cut their reserve requirement ratio in an attempt to open up the lending spigots in the banking sector. Covid remains an issue with Covid cases rising to a new record, but oil prices are higher today with the January contract trading at $79.50 area up over 2% on the day. It traded as low as $76.85 on Wednesday and $75.30 on Monday. That was the lowest level since the start of the year.

A look at other markets today shows:

- Spot gold is trading down $3.40 or -0.20% at $1750.96

- spot silver is trading down $0.23 or -1.07% at $21.27

- WTI crude oil is trading at $79.59 that's down 2.12%

- The price of bitcoin is trading steady at $16,505. The low price reached $16,339. The high price extended to $60,604. The low price from Monday's trade reached $15,479 which was the lowest level since mid November 2020.

Looking at the premarket for US stocks, the major indices are trading mixed with the NASDAQ index lower and the S&P and Dow industrial average are higher.

- Dow industrial average up 60 points after Wednesday's gain of 95.96 points

- S&P index is trading up 3.5 points after Wednesday's a gain of 23.70 points

- NASDAQ index is down 30 points after Wednesday's 110.91 point rise

The major indices are up for two consecutive days coming into today's trading.

In Europe, the major indices are mixed:

- German Dax, -0.07%

- Frances CAC, +0.09%

- UK's FTSE 100 +0.23%

- Spain's Ibex +0.05%

- Italy's FTSe MIB +0.08%

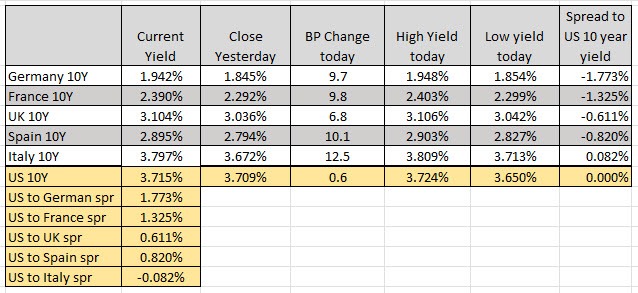

in the US debt market, yields are mostly higher:

- two year 4.489%, +0.7 basis points

- five year 3.909%, +1.2 basis points

- 10 year 3.716% +0.7 basis points

- 30 year 3.748% +0.7 basis points

in the European, that benchmark 10 year yields are higher across the board. As mentioned above the two – 10 year spread in Germany is at its most inverted in decades: