The USD is moving higher.

Looking at the dollar index (DXY) the price is testing the 200 day MA at 103.79. The price moved above that level on Friday reaching a high of 103.88, before failing and rotating lower. The high has just extended to 103.803. Get and stay above to 200 day MA, and the door opens for more upside momentum.

On the top side, the 61.8% retracement of the move down from the 2024 high to the 2024 low comes in at 104.074. That would be the next key target.

Meanwhile, the

- EURUSD is trading to a new low at 1.0828. The low price from last week comes in at 1.08106 and is the next downside target

- GBPUSD has fallen below the September 11 low target and natural support near 1.3000. The low price from last week reached 1.2974 and is the next downside target.

- USDJPY is trading to a new session high at 150.266 and stretches toward the high price from last week at 150.316. Its 100-day moving average and 50% midpoint of the move down from the July 2024 high comes in and at 150.757. That is a key target on the top side for the pair.

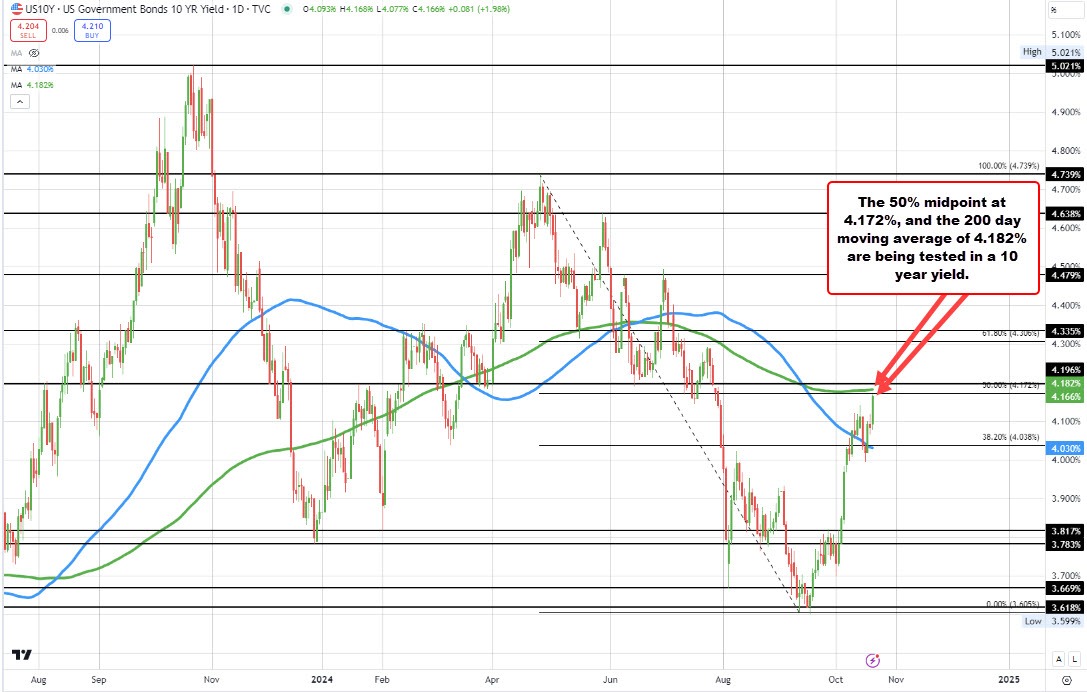

Yields are moving higher which is helping the USD move higher.

Looking at the yield curve:

- 2-year yield is back above 4% at 4.023%, up 7.0 basis points

- 5-year yield is at 3.961%, 8.4 basis points

- 10-year yield is at 4.160%, 8.6 basis points

- 30-year yield 4.464%, +8.2 basis points

The 10-year yield is trading at its highest level since July 31, and is stretching toward its 200-day moving average at 4.187%. The 50% midpoint of the 2024 trading range is near that level at 4.172%. That midpoint and the 200 day moving average are technical targets that if broken would tilt the technical bias more to the upside for yields. Stay below and we could see a rotation back to the downside. The 10 year yield reached a low of 3.605% in September.

With yields moving higher, stocks are moving lower.

- Dow industrial average is now down -340 points or -0.78% at 42935.87

- S&P -36.4 points or -0.63% at 5027.25.

- NASDAQ index is now down -101 points or -0.54% at 18388.50.

- The small-cap Russell 2000 is faring the worst when they decliner -34.15 points or -1.50% at 2241.90

The three major indices closed higher for the sixth consecutive week which is the longest streak in 2024.

Meanwhile, gold traded to a new all-time high of $2740.57 (its 43rd new record high this year), but has since backed off and trades near unchanged at $2720.30 as it reacts today higher dollar/higher rates.