The USDCHF is working on its 2nd down day in 3 days. That comes after 9 straight days to the upside.

The pair moved sharply lower on Wednesday on dollar selling after the FOMC rate decision and Powell's comments that a 75 basis point hike was off the table.. Yesterday, all that was reversed and the price moved higher for the 10th time in 11 days.

Yesterday, the price high reached 0.98892. That got within 10 pips of the swing high going back to March 2020 which stalled at 0.98994 (call it 0.9900). Sellers leaned ahead of the level (with stops likely on a break above).

Today, the price moved up to 0.9887 before rotating back to the downside. Sellers continue to lean against the March 20 high. The current price is trading at 0.9828. That's testing the lows for the day.

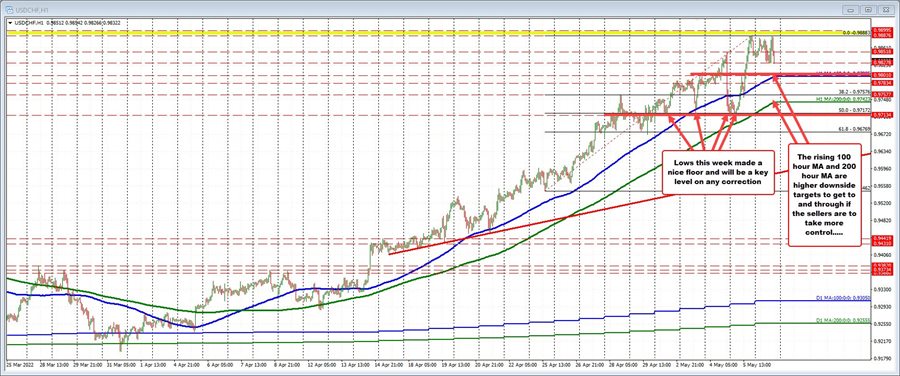

Drilling to the hourly chart, there are a number of swing lows at the 0.98278 level. A move below it would have traders targeting the 100 hour moving average (blue line in the chart below) at 0.97985 (and rising).

Below that is the 200 hour moving average at 0.97423.

Just like there is a ceiling at the highs yesterday and today, the low prices this week stalled near a floor area around 0.9713. Lows on Monday, Tuesday, Wednesday and Thursday came in between 0.97086 (reach yesterday) and 0.97197 (reached on Wednesday). The floor at that area between 0.97086 and 0.97197 will be important area on correction to the downside. Move below and there could be further downside momentum after the sharp move higher seen in April and into early May.