Fundamental Overview

The USD continues to consolidate around the highs except against the commodity currencies where it extended into new highs. The US inflation data last week was once again a disappointment although the data that feeds into the Core PCE was overall benign as forecasters expect a 0.13% M/M increase.

Nonetheless, the Treasury yields have continued to climb and are now back around the post-US election highs. There’s some understandable uneasiness in the bond market given the hot US data and the Fed continuing to cut into an accelerating economy.

The Fed today is expected to cut by 25 bps bringing the FFR to 4.25-4.50%. We will also get the updated Summary of Economic Projections (SEP) where growth and inflation should be revised upwards, and the Dot Plot will likely show two rate cuts in 2025. Fed Chair Powell should acknowledge the strength in the US data and announce a slowdown in the pace of easing.

This is already priced in as the market expects just two rate cuts in 2025, with the first one coming in March at the earliest. Therefore, the market reaction will be driven by deviations from the expectations.

On the JPY side, nothing has changed fundamentally, and the market firmed up the expectations for no change at this week’s BoJ decision. Most of the USDJPY gains though have been driven by the rise in Treasury yields, so the focus now is on the FOMC decision as it will impact Treasury yields and therefore the USDJPY pair.

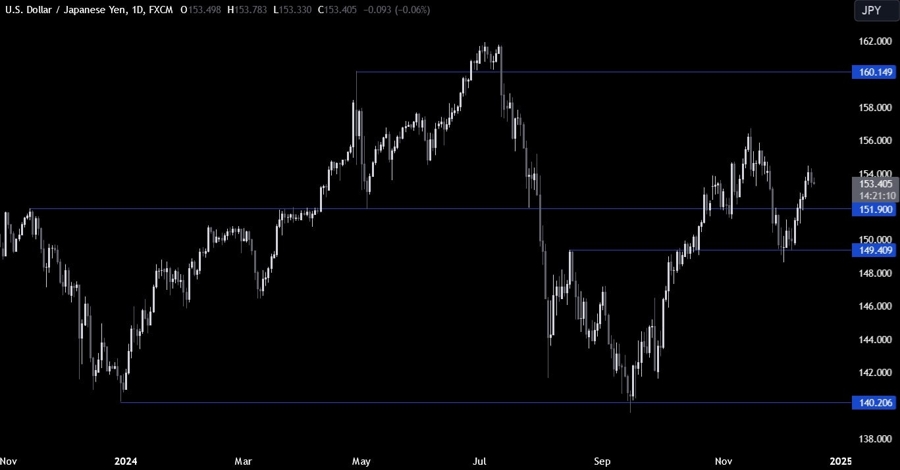

USDJPY Technical Analysis – Daily Timeframe

On the daily chart, we can see that USDJPY pulled back a bit from the recent high as we head into the FOMC. From a risk management perspective, the buyers will have a better risk to reward setup around the 151.90 support to position for a rally into the 160.00 handle next. The sellers, on the other hand, will want to see the price breaking lower to increase the bearish bets into the 149.40 level.

USDJPY Technical Analysis – 4 hour Timeframe

On the 4 hour chart, we can see that the price broke below the upward trendline that was defining the bullish momentum on this timeframe. This might be a signal for a deeper pullback into the 151.90 support. The sellers will likely pile in around these levels to position for a drop into the support, while the buyers will look for a rally back above the trendline to position for new highs.

USDJPY Technical Analysis – 1 hour Timeframe

On the 1 hour chart, we can see that we have a counter-trendline defining the current pullback. The sellers will likely lean on this trendline to keep targeting the support, while the buyers will look for a break higher to position for new highs. The red lines define the average daily range for today.

Upcoming Catalysts

Today, we have the FOMC Policy Decision. Tomorrow, we have the BoJ Rate Decision and the US Jobless Claims figures. On Friday, we conclude the week with the Japanese CPI and the US PCE data.